Bridgestone, 2Q's cumulative sales revenue increased 24%year -on -year, increasing sales mainly for repair during the recovery of extended tire demand.

2021 2nd Quarter Accumulated Financial Results and Main Initiatives

Mr. Thank you very much for participating in today's financial results briefing for the second quarter of 2021. I will give you an overview of our consolidated financial results for the first half of 2021 and explain the status of initiatives based on the medium-term business plan announced in February.

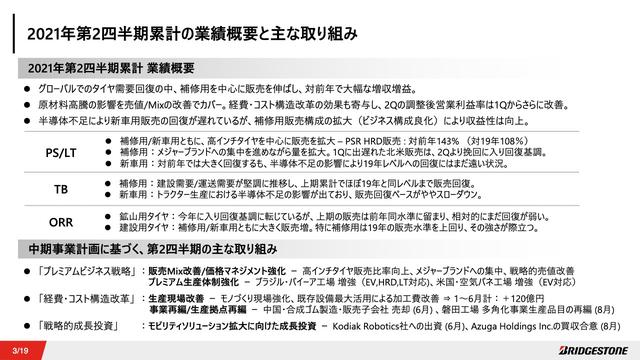

As global tire demand recovered, sales increased, mainly for aftermarket tires, resulting in significant year-on-year increases in sales and profits. We covered the increase in costs due to soaring raw material prices by improving selling prices and product mix, which we are working on as a key strategy. Adjusted operating margin for the second quarter improved further from the first quarter due to the effects of expense and cost structure reforms.

I will explain the sales situation by product. As for PS/LT tires, sales of high-inch tires of 18 inches or more increased steadily in 2019 as well.

We increased the volume of aftermarket products while concentrating on major brands. North America, where sales were slow in the first quarter, recovered from the second quarter and entered a recovery trend. Due to the shortage of semiconductors for new cars, the situation is still far from the level of 2019.

While TB tires for repair use have recovered significantly, supported by strong demand for construction and transportation, sales for new car tires have been affected by the shortage of semiconductors like PS/LT tires.

For ORR tires, although mining tires started to recover this year, the recovery is still weak. Sales of construction tires are growing significantly against the backdrop of robust construction demand.

Based on the medium-term business plan announced in February, we are promoting structural reforms with a view to 2023. I will explain the details later, but as part of our premium business strategy, we plan to strengthen our premium production system for the future.

Regarding expense and cost structure reforms, we were able to improve processing costs by a total of 12 billion yen in six months by strengthening manufacturing sites and maximizing the use of existing facilities. We are also steadily implementing business restructuring and restructuring of production bases.

With regard to strategic growth investments, in June we invested in Kodiak Robotics, which develops long-distance truck autonomous driving technology, as growth investments aimed at expanding mobility solutions, and in August we invested in Azuga, a North American digital fleet solution provider. Announced an agreement to acquire Holdings Inc.

2021 2nd Quarter Cumulative Business Environment/Tire Demand

I will explain the 2nd quarter cumulative results. In terms of the business environment, the US dollar remained at the same level as the previous year, and the yen depreciated against the euro compared to the previous year.

In terms of raw material prices, although the rise in natural rubber from last year has slowed down, it continues to remain high. Oil prices have skyrocketed over the last six months.

Tire demand recovered significantly from the previous year, mainly in the United States and Europe. In North America in particular, aftermarket sales have recovered to a level that far surpasses 2019 levels. On the other hand, OE demand remained low compared to 2019 due to the semiconductor shortage.

2nd Quarter 2021 Cumulative Tire Sales Volume: Year-on-Year / Year-19 Years

Regarding tire sales, the six-month cumulative sales volume is shown year-on-year and 2019.

In 2019, PSR was 90% and TBR was 97% globally. In particular, TBR is showing a very strong recovery, with aftermarket sales in North America and Europe growing to levels above 2019. In PSR, the sales growth of high-inch tires of 18 inches and above continued to stand out.

In the ORR, sales of super-large tires were relatively weak compared to 2019, but sales of large-, medium- and small-sized tires recovered significantly against the backdrop of strong construction demand.

2021 Second Quarter Cumulative Consolidated Results

I will explain the consolidated results for the second quarter. Cumulative revenue was 1,568.8 billion yen, up 24% year-on-year, and adjusted operating profit was 176.2 billion yen, up 369% year-on-year. Quarterly profit attributable to owners of the parent company was 352.3 billion yen, a significant recovery from last year's loss.

The 352.3 billion yen includes 228.7 billion yen of profit from discontinued operations related to FIRESTONE BUILDING PRODUCTS in North America recorded in the first quarter.

In the second quarter, we were greatly affected by the soaring prices of raw materials, but we made efforts to improve profitability through efforts to rebuild our earning power, and the adjusted operating margin was 11.6%, further improving from the first quarter. I was able to

Factors for change in adjusted operating income for the second quarter of 2021: Difference from the previous year

I will explain the factors for changes in adjusted operating income from the previous year. In the cumulative second quarter, the impact of raw materials turned negative compared to the previous year, but it was offset by the improvement in selling prices and product mix. Increased sales centered on aftermarket products and associated improvements in processing costs were major factors in increasing profits. Excluding the impact of the construction materials business in the Americas, profits increased by 138.6 billion yen.

The processing cost improvement includes 12 billion yen, which is the improvement effect of the production site, which is being worked on as a key strategy based on the medium-term business plan.

As for operating expenses, in addition to the increase in variable costs due to the significant increase in volume, the soaring unit price of ocean freight weighed down profits. Improvements in the cost structure contributed to curbing increases in operating expenses overall.

2021 Second Quarter Cumulative Results by Segment

I will explain the results by segment. In the cumulative second quarter, all regions posted significant increases in sales and profits from 2020, which was affected by the novel coronavirus.

Especially in Europe, Russia, the Middle East, India, and Africa, volume and mix improved significantly, profitability improved significantly from the deficit in 2020, and the adjusted operating margin improved to about 5%.

2021 Second Quarter Cumulative Tire Business Performance by Product

I will explain the tire performance by product. Passenger car and light truck tire sales revenue was 789.4 billion yen, with an operating margin of 14.2%. Revenue from truck and bus tires was 370 billion yen, with a profit margin of 11.1%, both of which greatly improved profitability.

Specialties, which includes mining, aircraft, agricultural machinery, and two-wheel tires, generated revenue of 191.2 billion yen, with a profit margin of 18.9%. Although sales of mining tires and airplane tires are still at a weak level, profitability has recovered from last year and we have secured a high profit margin.

Cumulative 2nd Quarter of 2021 Diversified Business Performance

I will explain about the diversified business. Cumulative second quarter revenue was 179.7 billion yen, with an adjusted operating loss of 2.2 billion yen.

While the Diversified Americas Business and the Sports & Cycle Business are profitable, the profitability of the domestic chemical products business has improved compared to the previous year, but we continue to face issues with our business portfolio. We ended up with a yen deficit.

Second Quarter 2021 Statement of Financial Position and Cash Flow Highlights

I will explain the statement of financial position and cash flow highlights. Total assets amounted to ¥4,436.4 billion. The increase was 247.1 billion yen from the end of the previous year, mainly due to the cash inflow from the sale of FIRESTONE BUILDING PRODUCTS in the first quarter.

Equity ratio rose 6.9 points year-on-year to 58.2%, continuing to be in a healthy state. As for free cash flow, investment cash flow was largely in the direction of cash inflow due to the sale of the business, resulting in 381.4 billion yen.

2021 Second Quarter Cumulative "Adjustment Items" and "Quarterly Profit from Discontinued Operations"

I will explain adjustment items and quarterly profit from discontinued operations. Adjustment items included ¥5.1 billion in overseas factory closure and restructuring costs, ¥1.7 billion in impairment losses, and minus ¥0.3 billion in other items, for a total of ¥6.5 billion.

As FIRESTONE BUILDING PRODUCTS was classified as a discontinued operation, the total gain on sale of FIRESTONE BUILDING PRODUCTS and the quarterly profit generated from this business from January to March of 228.7 billion yen was Recorded as quarterly profit from continuing operations.

Assumptions for formulating full-year earnings forecasts for 2021

I will explain the assumptions for formulating full-year earnings forecasts for 2021. As for exchange rates, the yen is expected to remain weaker against both the US dollar and the euro compared to the assumptions in the plan announced in February. Raw material prices are expected to remain high throughout the year, continuing from the first half.

Tire demand is expected to increase steadily year-on-year as the global recovery trend continues. OE demand, which was strongly affected by the shortage of semiconductors in the first half, will be resolved in the second half. , assuming demand will recover.

Full year 2021 tire sales forecast: vs. previous year

We will explain the full year 2021 tire sales forecast. It shows the sales forecast year-over-year in 5 percent increments.

We are planning a significant year-on-year increase in sales in all regions for both new vehicles and repairs. From a product-by-product perspective, we anticipate a strong recovery in sales of large, medium- and small-sized TBR/ORR against the backdrop of particularly strong demand for construction and transportation.

In PSR, sales of high-inch tires of 18 inches and above are expected to continue to grow significantly.

Consolidated earnings forecast for the full year 2021

This is the consolidated earnings forecast for the full year 2021. Full-year revenue is 3,320 billion yen, an increase of 18% from the previous year and an upward revision of 10% from the previous forecast announced in February. Adjusted operating profit is 360 billion yen, an increase of 85% year-on-year and an upward revision of 38% from the previous forecast. Quarterly profit attributable to owners of the parent company is expected to be 325 billion yen, a significant recovery from last year's deficit.

Our management indicators are ROIC of 8.3% and ROE of 10.4%.

2021 Full Year Adjusted Operating Income Change Factor Forecast: Difference from Previous Year

In the full year forecast, we will explain the factors behind the year-on-year change in adjusted operating income.

For the full year, we anticipate that the negative impact of rising raw material prices will expand significantly, but we expect that most of this will be covered by improving selling prices and product mix. Increased sales volume and improvement in processing costs will be major factors in increasing profits, so we expect an increase in profits of 165.1 billion yen year-on-year, excluding the impact of the construction materials business in the Americas.

Operating expenses have increased significantly year-on-year, but in addition to the increase in variable costs due to a significant increase in sales volume, the impact of soaring ocean freight rates and gains on the sale of fixed assets recorded as negative operating expenses in the previous year. This is because it includes the impact of We plan to continue to rigorously improve our structure for variable and fixed costs.

Revision of dividend forecast

I will explain the revision of the dividend forecast. We revised our basic dividend policy in February of this year, and our basic policy is to strive to increase the amount of dividends in a stable and continuous manner through continuous improvement in corporate value.

The results for the first half ended at a level that exceeded the forecasts announced in February 2021, and the full-year results were also revised upward. Based on the results of this recovery in business performance, as a result of consideration based on the basic policy, we decided to revise the dividend forecast to 85 yen for the interim dividend and 85 yen for the year-end dividend, for an annual dividend of 170 yen.

We will continue to strive to meet the expectations of our shareholders by stably and continuously increasing the amount of dividends linked to the improvement of our business performance.

That's all for me. Thank you for your attention.

Bridgestone 3.0 Journey toward 2030

Shuichi Ishibashi (Ishibashi): Hello everyone. I am Ishibashi, Global CEO. I will explain the initiatives, implementation and results for the first half of 2021, and the progress of the medium-term business plan.

The medium-term business plan announced in February covers the period from 2021 to 2023. The theme is “creating a competitive edge and gaining a competitive advantage,” and it is positioned as a specific action plan for its realization.

We are working to expand and strengthen our tire business, which we create and sell, as our core business and our solutions business as a growth business. Furthermore, as an exploratory business, we have started considering a recycling business that "returns" tires to raw materials.

In 2030, in all businesses of “creating and selling,” “using,” and “returning,” the business value of sales and profits will be linked to circular economy and carbon neutral activities. We aim to keep going in a circle like this.

Bridgestone 3.0 Business Scenario: Medium-Term Business Plan (2021-2023) “Attack” and “Challenge”

We will promote rebuilding of earning power while thoroughly managing. Looking to the future, we have also started full-scale strategic growth investment. With an aggressive and challenging stance, we will accelerate our actions in line with the medium-term business plan.Medium-Term Business Plan (2021-2023) 2021 full-year forecast "implementation" and "results" ①

I will explain the implementation and results based on the full-year forecast for 2021. We will strongly promote the rebuilding of our earning power, which we started last year. Revenue is expected to reach the 2022 level of the medium-term business plan ahead of schedule. The gross profit margin is also expected to improve significantly compared to the plan, approaching the 2022 level of 40%. Continuing from the first half, we will focus on execution and results.

Medium-Term Business Plan (2021-2023) 2021 Full-Year Forecast "Execution" and "Results" ② Achieve ahead of schedule. In order to achieve the 2023 level ahead of schedule, we will continue to thoroughly rebuild our earning power and accelerate our transformation into a strong Bridgestone.Mid-Term Business Plan (2021-2023) First Half of 2021 Progress: “Attack” and “Challenge” ①

I will explain the highlights of the first half of each business. In our core business, we rebuilt our earning power and implemented a premium business strategy. We will continue to rigorously improve the quality of our business. We are concentrating on high-inch passenger car tires and major brands to expand sales and improve the mix of all products globally.

We continue to strengthen price management, including price increases, in response to rising raw material prices. Improvements at the production site also lead to continuous results. Flexible and agile management centered on the supply chain is steadily incorporating the recovery trend and supports aggressive sales plans.

We are also developing a system to “create” premium products. To respond to the accelerating shift to EVs and strengthen our Dan-Totsu product strategy, we are promoting the expansion and enhancement of ENLITEN technology as a new premium in anticipation of the evolution of sustainability and mobility.

For expense and cost structure reforms, we will continue to consider and implement the reorganization of business and production bases while thoroughly managing expenses and costs.

Medium-Term Business Plan (2021-2023) First Half of 2021 Progress ``Aggression'' and ``Challenge''②

We have started full-scale strategic growth investment as a growth business. Starting with the agreement to acquire U.S. digital fleet solutions provider Azuga Holdings Inc. announced on August 3, we are working to expand mobility solutions, including investment in Kodiak Robotics, which develops long-distance truck autonomous driving technology.

We have newly established the position of Global Chief Business Solutions Officer in order to speed up and promote the solution business while ensuring global consistency. We have appointed Paolo Ferrari as the head of Bridgestone Americas, and we are expanding and strengthening our business under his strong leadership.

We have also set up a Global Business Solutions Model Committee to promote discussions on global information sharing and execution.

For the exploratory business, we will continue to search for technology seeds, and have set up business preparation offices for recycling and soft robotics, respectively, and have established a system to promote initiatives for commercialization.

In order to strengthen our management structure, we have established an expanded Global CFO function. We are also strengthening the systems and processes that support the implementation of M&A and investments. As for HRX, we are continuing to promote initiatives such as maintaining a lean organizational structure.

Core Business: Rebuilding Earning Power Premium Business Strategy

I will explain the details of rebuilding earning power, strategic growth investment, and strategy execution system.

Regarding rebuilding the earning power of our core businesses, the tire business has been steadily recovering since the beginning of this year. .

We promoted flexible and agile management centered on the supply chain. We are reviewing our global sales with an aggressive and challenging attitude, creating a supply plan that corresponds to that, and building a system that can respond agilely to changes in the environment.

For example, in the first half of this year, we plan to recover demand in Europe and the United States and plan aggressive sales, maximize local production capacity, promote local production for local consumption, and lack in agile supply support from Japan and the Asian region. It complements the bun.

We strengthened sales in North America, which was an issue in the first quarter, and this led to results in the first half. Going forward, we will continue to promote flexible and agile management with an aggressive stance.

The reduction of processing costs through improvements at the production site has resulted in an improvement of approximately 12 billion yen over the previous year in the first half. We will continue to support Asia, Europe and the Americas with Japan as our core.

To strengthen premium sales, we are continuing to expand sales of high-inch tires. In Europe and the United States, the level exceeds the plan for 2021, and in emerging countries, we are expanding as planned. We will continue to thoroughly improve the quality of our business globally.

Core Business: Premium Business Strategy 1

In the Premium Business Strategy, we are strengthening our system to create premium products with an eye on the evolution of sustainability and mobility. In preparation for the accelerating CASE trend, especially the expansion of electrics and EVs, we have increased the production capacity of the Bahia plant in Brazil. We will respond to the expansion of sales of high-inch tires for passenger cars for EVs in the Americas.

Furthermore, we are moving ahead of schedule to consider strengthening our global production system for premium products. As for Dan-Totsu products, we are promoting the expansion and enhancement of ENLITEN, an innovative tire technology that achieves both environmental products and driving performance.

Our diversified business is also responding to the shift to EVs, and we have decided to expand the air spring factory of Firestone Industrial Products in the United States. We develop and manufacture products that contribute to improving EV power consumption and battery protection.We will continue to respond to the growing demand for EVs, centering on air springs. The air spring business is also a highly profitable business, and is expected to contribute even more to the Group in the future.

Core Business: Premium Business Strategy 2

Our Dan-Totsu products have been adopted by new car manufacturers around the world and are installed in many EVs and FCVs.

We are also promoting co-creation with emerging EV manufacturers. On August 6, we announced a partnership with Fisker of the United States to develop and supply tires for electric SUVs. POTENZA SPORT tires equipped with ENLITEN technology will be installed on the electric SUV Fisker Ocean, which is manufactured with sustainable materials such as an interior made of recycled materials and plant-derived materials.

Including the co-creation with Lightyear, which I explained in May, we would like to continue working toward the realization of a sustainable mobility society, with new partners empathizing with us.

Restructuring Earnings Power: Expense Cost Structure Reform

For expense and cost structure reforms, we are continuing to consider restructuring production bases and businesses, and have restructured 23 bases so far. Going forward, we will continue to consider all businesses, including in-house production and diversified businesses, over the medium to long term.

Core Business & Growth Business: Intentional Restructuring Four Categories for Execution

MAIN・NEXT set in the medium-term business plan, mainly based on the execution and results of the core business・I will explain the progress of the four categories of STRATEGIC and DEVELOPING.

We will continue to strengthen and expand MAIN and NEXT. The European business, which we positioned as STRATEGIC, achieved profitability by thoroughly rebuilding the earning power of our core business.

The Russia and Africa business, which was positioned as DEVELOPING and aimed to get out of the red, is expected to achieve profitability in 2021. We are beginning to see results from rebuilding our earning power, and efforts to transform Bridgestone into a stronger Bridgestone are progressing in each region.

Core Business: Japan Business Premium Business Strategy -MAIN- I'm here.

There are two lines of ALENZA for premium SUVs: ALENZA 001 and ALENZA LX100. "ALENZA 001" draws out the dynamic performance that has been trained in the European market to a high level and provides a high-quality driving experience. The "ALENZA LX100" is a new premium tire for this year, based on the technology of the "REGNO" brand, which has been active in Japan for many years. .

BLIZZAK VRX3, which is scheduled to be released in September this year, is a new product of a new dimension of studless tires for passenger cars that has achieved two generations of evolution. It has the highest performance in the history of "BLIZZAK" and provides customers with peace of mind and safety on winter roads.

By simplifying and differentiating, we are the first in Japan to adopt commonality and modularity, which can improve the efficiency of the entire value chain, including development man-hours, production, and logistics, and reduce costs.

Although it is still under development, we will use AI and other digital technologies to coordinate with a demand forecasting system that accurately captures tire sales trends and seasonality, enabling us to quickly deliver the necessary response when our customers need it. I'm going to fix it.

Such efforts also contribute to sustainability by making tire delivery more efficient. We will continue to support the safety and security of our customers on various roads in Japan.

Rebuilding Earning Power: Europe, Russia and South Africa Business - STRATEGIC & DEVELOPING -

Since last year, the European business has thoroughly implemented a premium business strategy across the entire value chain. We are promoting improvements to the production site, including support from Japan, and the closing of the Bethune factory in France is leading to improvements in fixed costs and processing costs.

On the sales side, we withdrew from associate brands and implemented a sales strategy that concentrated on major brands and high-inch tires. We are also implementing strategic price increases based on Dan-Totsu products to improve profits.

For the full year forecast for 2021, our end-to-end efforts have paid off, and we have achieved profitability ahead of schedule in 2022. We will continue to strengthen and maintain this profit base and strengthen our contribution to global strategies as a strategic function.

DEVELOPING's Russia/Africa business is expected to get out of the red by implementing thorough operational improvements. Going forward, we will step up to NEXT and aim for stable profitability and growth.

Growth Businesses: Strategic Growth Investment Global Expansion of Mobility Solutions①

I will explain growth businesses and strategic growth investments. As announced on August 3, we have agreed to acquire Azuga Holdings Inc. Azuga Holdings Inc. provides digital fleet solutions to approximately 200,000 contracted vehicles for over 6,000 carriers in the United States.

Our group provides tire-centric solutions that utilize cutting-edge tire technology and retreading to carriers in North America on a scale that is top-class in the industry. With the addition of Azuga Holdings Inc. to our group, it has become possible to provide digital mobility solutions to an even wider range of customers.

Synergies are expected in the evolution of tire-centric solutions by utilizing operation data in vehicles and transportation, and in core businesses, such as the development of Dan-Totsu products and the expansion of the customer base in tire sales.

Growth Business: Strategic Growth Investment Expansion of Global Deployment of Mobility Solutions ②

Through strategic growth investment, our group's mobility solutions will expand globally. With the addition of Azuga Holdings Inc. to Webfleet Solutions, which has the No. 1 position in Europe, after the acquisition is completed, we will provide solutions for about 1 million contracted vehicles, mainly in Europe and the United States.

With Webfleet Solutions as the core, we will continue to expand into Europe and other regions, and utilize the experience and know-how cultivated in Europe to scale up in North America, which is expected to be the largest market.

Through the Global Business Solutions Model Committee, which I explained at the beginning, we will continue to expand and strengthen mobility solutions while sharing and discussing them globally, and take on the challenge of creating social value and customer value.

Growth Business: Strategic Growth Investment Expansion of global mobility solutions expansion ③

In the United States, we have decided to invest in Kodiak Robotics, which develops long-distance truck self-driving technology. Currently, Kodiak Robotics is providing advanced autonomous driving technology to customers in Texas, and is currently implementing autonomous driving with a safety driver.

We would like to contribute to the development of safe vehicle operation and self-driving technology through synergies between our tire sensor technology and tire-centric solutions. Furthermore, we would like to expand our Dan-Totsu products and solutions by utilizing the data obtained by connecting with autonomous vehicles.

As a leading company in the tire industry, we aim to develop a more sustainable, safer, and more secure mobility society.

Strengthen strategy execution system-Strengthen financial strategy foundation: Strengthen management structure Promote portfolio management

We are also strengthening strategy execution system to support strategic growth investment and rebuilding earning power .

As of September 1, we have newly established the expanded Global Chief Financial Officer function to strengthen our management structure. Financial planning & analysis, that is, business planning and management accounting functions, will be combined with the existing financial functions to consolidate and integrate the management functions of business administration, procurement, and IT infrastructure. By strengthening our management structure, we aim to continuously improve our financial value.

We are also continuing to promote portfolio management. We are promoting ROIC penetration activities in all global businesses and regions, appointing ROIC ambassadors in each business and region, and accelerating improvement activities at the site level.

In order to rigorously evaluate strategic growth investments, we will strengthen the global controller function, operate a global M&A and investment committee, and develop a process that allows for global and diverse discussions and prompt decision-making. doing. We will develop a management structure and framework to improve financial value and accelerate our transformation into a strong Bridgestone.

HRX: Personnel and organizational strategies that support the medium-term business plan

HRX will promote the separation of core, growth, and exploration business organizations in a step-by-step manner, and the organizational structure of each business. is also being improved.

HRX: Bridgestone's HRX (Japan)

In Japan, Bridgestone's HRX is named "B-HRX", and we are creating an environment where the company and diverse individuals can grow together. . Human resources are the most important element in our medium-term business plan, and we will continue to promote system and system reforms that support the growth of hard-working people.

HRX: Strengthening the system to support technological innovation (Japan)

We are also strengthening the system to support technological innovation. Regarding product development, we have introduced a chief engineer concept to improve the certainty of technological development and accelerate the speed of product development.

The product planning chief engineer ensures the consistency of the entire value chain from product planning to development, production and sales for each project. We are building a quick and agile development system in conjunction with our product strategy.

Bridgestone Innovation Park, which is scheduled to be completed at the end of this year, aims to increase productivity and create an optimal place for diverse and flexible work styles. We will promote a new work style strategy that allows employees to choose a workplace that matches their goals and activities.

HRX: Organizational and Personnel System Reform (Japan)

In light of the past issues of organizational bloat, the organizational system reform will reduce the organization from 5 levels to 3 levels as of January 1 this year. We have simplified it into hierarchies and reorganized it into a lean organizational structure.

As a mechanism to maintain a lean organizational structure, we have built a process for continuously reforming the organization and personnel system by rotating the PDCA cycle in each department every six months.

Managers clarify the role of each position, manage the number of positions at a certain number, and match human resources to positions with the right person in the right place. We will continue to improve our organizational structure by coordinating efforts to support those who work hard.

Progress toward Realization of the Sustainability Business Concept

Sustainability, which is at the core of our management, is focused on achieving carbon neutrality and a circular economy. In May, we reported that we have achieved 100% renewable energy at our tire plants in Europe.

In July, we achieved 100% renewable energy for purchased electricity at our four domestic plants in Hikone, Kitakyushu, Tosu, and Shimonoseki. As a result, CO2 emissions from all tire plants in Japan have been reduced by approximately 30% compared to 2011 on an annual basis.

We are also working to raise awareness of carbon neutrality. Since 2011, we have introduced in-house carbon pricing for investment decisions, and this time, we have set this unit price at 60 US dollars per ton for the Group's CO2 emissions at the manufacturing stage and strengthened its operation. We are also promoting awareness of internal carbon pricing throughout our corporate activities.

In order to strengthen our sustainability efforts, we have also revamped our execution system. In addition to strengthening the Global Sustainability Division at the Tokyo head office, we have established a new Global Sustainability Business Committee to promote linkage between sustainability and business. We will strengthen our structure to realize the sustainability business concept on a global basis.

Our Way to Serve: Supporting the Lives of Individuals and Local Communities (1)

About one of the sustainability issues, "Initiatives for a society where everyone can play an active role," I would like to talk about how to improve corporate value for children.

Our group's social contribution activities are guided by our global CSR system, "Our Way to Serve." In order to help people move, live, work, and enjoy themselves more comfortably, by linking it with the English translation of our mission, "Serving Society With Superior Quality," Focusing on the three priority areas of "mobility," "individual lifestyles," and "environment," we are promoting various activities.

This time, I will explain mainly about "the life of each person". For Diversity & Inclusion, we accept diversity and focus on creating an environment where all employees can easily demonstrate their abilities. This year, we participated in "The Valuable 500," an international movement that promotes the active participation of people with disabilities, and strengthened our group's efforts.

In the "PRIDE index" that evaluates LGBT initiatives in Japan, we have received the highest rating of Gold for three consecutive years. We would like to continue to develop a workplace environment where diverse people with different values and personalities can work comfortably and play active roles globally.

Our Way to Serve: Supporting the Lives of Individuals and Local Communities②

In response to the ongoing spread of the novel coronavirus, we have been promoting various local contribution activities around the world. In response to the rapid spread of infection in India, Japan, Europe and the United States cooperated to provide support such as ventilators.

In Spain and France, employees are making sincere efforts to overcome the crisis together with stakeholders in the local community and society, voluntarily at each site, such as by providing a 24-hour free tire maintenance service for emergency vehicles. increase.

In Japan, occupational vaccination of the new coronavirus vaccine started in late June. Based on the premise that "safety comes first," we are promoting vaccinations for group employees, their families, business partners, etc. at 16 business sites in Japan so that as many people as possible can be vaccinated as soon as possible. I'm here.

Our Way to Serve: Supporting the Lives of Individuals and Local Communities③

Conservation of biodiversity and the environment, implementation of environmental awareness events, activities to protect local infrastructure, and learning for the next generation We carry out activities around the world to support We will continue to promote such social contribution activities and fulfill our responsibility for the future as a leading company in the tire and rubber industry.

That concludes my explanation of the progress of the medium-term business plan.

Bridgestone's Approach to Improving Corporate Value

The figure on the slide summarizes our approach to improving corporate value through the business activities and social contribution activities of the Bridgestone Group.

Our mission is to contribute to society with the highest quality as the basis of all corporate activities, and in business, we will expand our value into solutions and exploration businesses, with the tire business as our core, in line with our medium-term business plan. We will take on the challenge of creating social value and customer value and gaining a competitive advantage.

Our social contribution activities create social value through activities based on our policy of “Our Way to Serve,” and lead to the development of trust from society and all stakeholders.

It is human resources that support them, and corporate governance as the foundation of value creation. It is our way of thinking that we aim to evolve into a sustainable solution company that contributes to sustainable overall corporate value in terms of both financial and non-financial value through business and social contribution activities.

From "Roads of the World" to "Moon Surface"

Finally, I would like to introduce you to a dream project. We are participating in an international space exploration mission with a manned rover together with the Japan Aerospace Exploration Agency and Toyota Motor Corporation.

Our tires are scheduled to be installed on the "LUNAR CRUISER" used for lunar exploration. In a harsh environment where neither air nor rubber can be used, 100% metal airless tires woven with steel fibers support the dreams of mankind from the ground up.

This challenge is also introduced in commercials, along with "Let's go anywhere", which was written and composed by Asei Kobayashi as a commercial song for Bridgestone.

To date, tires have evolved along with mobility and have supported people's mobility. Every time we meet our dreams, our tires continue to evolve. Our group also wants to carry the dream of mankind on our shoulders and take on the challenge of the harsh lunar environment. In the late 2020s, before the 100th anniversary, we will see tires running on the moon.

Second year of Bridgestone 3.0, the third founding In the second half of the year, we will continue to focus on producing results through aggressiveness, challenge, and execution.

Thank you for your attention.

Questions and Answers: About the Tokyo 2020 Olympic and Paralympic Games

Questioner 1: About the Tokyo 2020 Olympic and Paralympic Games. The Tokyo 2020 Olympics ended the other day, and while there are various dramas such as winning a large number of medals, there are also criticisms, and the number of infected people is increasing.

Various things such as success or failure are said after finishing. As a sponsor, please tell us about your reception and evaluation of the Tokyo 2020 Olympics. Also, please let us know if you have any comments for the Tokyo 2020 Paralympic Games.

Ishibashi: I believe that the Tokyo 2020 Olympics was made possible by the efforts of everyone involved in the various games, medical personnel, and volunteers, to ensure the safe and secure operation of the Games. As a sponsor and as a Japanese citizen, I am very grateful.

I am well aware that there are various opinions regarding the Tokyo 2020 Olympic and Paralympic Games. "United by Emotion" and "Stronger Together" became major themes this time.

At first, I talked with the International Olympic Committee and became a top sponsor because I aspired for peace and sympathized with the Olympic spirit of "Unity in Diversity", which is to overcome various differences and become one. In that sense, I think we can return to our starting point and become one with emotions in various situations.

In addition to the Olympic Charter's "Faster, Higher, Stronger", this time "Together" is also a major theme. I think that "together" has a very big meaning.

We initially co-sponsored the Tokyo 2020 Olympic and Paralympic Games with five objectives. Of course, as a base, we sympathize with that spirit, but we will strengthen our brand, strengthen our business, showcase innovation, engage our 140,000 employees globally, and further strengthen diversity and inclusion. about it.

These five goals were our goals, but unfortunately we weren't able to strengthen our brand, strengthen our business (including invitations), and showcase innovation.

However, Bridgestone has 70 athlete ambassadors globally. Among them, 32 athletes came to Japan for the Tokyo 2020 Olympics. 20% of the 32 people are Japanese, and the remaining 80% are from overseas.

I feel very happy that these people have won 24 medals, and as a member of our team, they have shared and delivered their excitement to the world. We also provided and maintained tires for 3,000 official vehicles and provided and maintained 800 bicycles to support the operation of the tournament.

Although it is a very unsung support, 100 colleagues sweated every day at the site and maintained the tires and bicycles. I would also like to thank the 300 Bridgestone employees who volunteered for the success of the event.

For that reason, I think it was extremely valuable in terms of the engagement of our 140,000 global employees. I think that has changed a lot. Naturally, I feel that we are at a turning point, including our own employees.

In terms of diversity and inclusion, about 12 of our global colleagues and athletes will participate in the Tokyo 2020 Paralympic Games.

20% of them are Japanese and 80% of them are overseas ambassadors. I hope to become

Q&A: Responding to rising shipping costs

Questioner 2: On page 9 of the medium-term business plan slide, there was an explanation of flexible agile management. You said that you would supplement the strong demand in Europe and the United States from Japan and other Asian countries, but I think that the rising cost of marine transportation has become an issue. I would like to hear your specific strategy regarding the magnitude of this impact, how you will proceed with measures other than passing on the price, and what strategies you will use to reduce the negative impact.

Ishibashi: I see this as a common issue not only for Bridgestone and the tire industry, but for all industries. At sea, it is not a question of money, but of lack of capacity, and the situation is such that the goods themselves cannot be transported.

In the past, Bridgestone has been engaged in marine operations with various business partners, but this time we are cultivating new partners and working with them.

Because of this situation, naturally, we will greatly increase the sea freight. Given the current situation, we would like to capture demand in Europe and the United States, even if it means raising the price, and cover that in terms of mix and price.

Bridgestone's basic premise is local production for local consumption in Europe and the United States. Even if the cost is somewhat high, we will complete it.

Hishinuma: I will explain the cost impact. The impact of the increase in ocean freight unit prices was 4 billion yen in the first half, resulting in an increase in costs of 14 billion yen for the full year. I would like to absorb it by improving .

Q&A: Plans to expand the solutions business as a growth business in Japan

Questioner 3: Regarding the medium-term business strategy, you said that you would like to expand the tire solutions business as a growth business. . First of all, I understand that it will be expanded in Western countries, but please tell me how you plan to expand it in Japan in the future.

Ishibashi: Solutions as a growth business are divided into two: solutions centered on tire retreading and mobility solutions. Currently, mobility solutions are expanding mainly in Europe after the acquisition of Webfleet Solutions, and this time, with the acquisition of Azuga Holdings Inc. in North America, it will be further strengthened.

Because Webfleet Solutions has bases in Europe, the United States, South Africa, Australia, Chile, and Mexico, we are also engaged in various activities in the field of mobility solutions.

We will promote tire-centric solutions centered on retreading in Japan, Europe, and the United States, including "Mobox" and subscription business models. Including, of course, Asia.

In Japan, first of all, we will work hard on tire-related solutions centered on retreading. In North America, nearly half of the new tires have a retreading business, but in Japan, unfortunately, only about 20%.

In Japan, we will somehow strengthen our tire-related solutions, including retreading. As a next step, we can consider mobility solutions, but we will start with tire-related solutions.

Questions and Answers: Soaring Raw Material Prices and Premium Routes

Questioner 4: This is a bit premature, but I would like to ask about your performance for the next fiscal year. In the second half of the current fiscal year as well as in the full-year revisions, I think the pattern was to manage the increase in raw material costs through mix and quantity.

In the medium-term plan mentioned earlier, it is said that it is ahead of schedule based on that, but I think that the impact of raw material prices will probably come out a little more in the next fiscal year, and various other things, such as steel cords. In the midst of improving considerably, including the , will you be able to handle it further in the current flow, such as improving the mix?

In addition, I thought that there would be a slight decrease in quantity among the premium routes that have revised prices, but as far as I can see, it is not so much, and rather only the good ones are harvested. It seems that. In the medium to long term, will you continue with the current flow, or will the volume drop at some point?

Ishibashi: As you know, the first raw material price hike is linked to the economy, and it goes up and down. I also believe that raw material prices will rise toward next year.

The basic idea of offsetting this by mix and price remains the same. At the same time, I would like to proceed with the business on the premise of rebuilding our earning power and making up for it by improving the quality of our business.

The second point, premium route and volume, is a rather difficult task. For example, in Europe this year, we will stop all business with DAYTON, an associate brand with about 1.5 million units, and other brands in the cheap zone other than "Bridgestone" or "Firestone".

Europe is going to extremes, but I think it's important for Europe and the United States to take advantage of it. It is to extend the whole while clarifying it.

We believe that if we do not do this, we cannot ensure continuity as a business, so we will increase overall sales while focusing on premium. Therefore, we will continue to expand our core business. To that end, we need Dan-Totsu products, and I think we need to launch more new premium areas.

For example, "ENLITEN" is a new premium, and through such activities, it is a bit of a trade-off, but by balancing this, I would like to work on it next year and the year after next.

Questioner 4: I'm sure you're aiming for the current feeling, but do you feel that you're getting a response to the contradictory way of doing things?

Ishibashi: Yes. The medium-term plan up to 2023 is a commitment, so we would like to achieve it ahead of schedule.

Ten years ago in 2010, we launched an eco tire called "Ecopia". After 10 years, we have reached a level of about 90%. Next is "ENLITEN", a product with technology at the next level of large mass.

10 years from now, it will be 90% again, and we intend to raise the next stage. I talked about the symbolic thing called "ENLITEN", but it is an innovation and a solution by implementing it in various places. In core, we will focus on premium and expand sales.

I think it's a question of whether it's okay, but this is what we want to do and will do.

Questions and Answers: Concerning the Dan-Totsu product of the Japanese business and the development of a demand forecasting system using AI

Questioner 5: Regarding the Japanese business described on page 15 of the medium-term business plan slide, It was explained that the Global CEO will be the first to adopt a sales structure for the Japan business, simplifying the business structure, strengthening the value chain, and adopting commonality and modularity.

In addition, you said that you would like to develop and utilize a demand forecasting system using AI. In particular, I would like to ask you to explain the demand forecasting system again in an easy-to-understand manner.

Ishibashi: We haven't announced it externally yet, but we are developing it with a partner in another industry.

This winter, we will take on the challenge of incorporating an inventory system and demand forecasting system that has been successful in other industries into Bridgestone and connecting it to the optimization of inventory and logistics. When the results come out, I would like to say, "It came out in such a form."

One of the big problems in the tire industry is the distribution of winter tires. As you are well aware, inventory is unevenly distributed. In addition, the inventory at the dealer level, sales companies, and distribution warehouses will be overwhelmed.

In such a situation, there is an industry custom of returning goods in the spring. As a whole, I would like to make it more efficient and simple, and while improving the service for the final customer, inventory is a cost to everyone, so I would like to increase efficiency while reducing costs.

I think it's really a win-win, and that kind of thing reduces inventory and reduces the number of logistics. In many ways,