Explains the merits and demerits of multiple securities accounts, how to use them and how to file a final tax return!

Not only those who are planning to open a securities account in the future, but also those who already have a securities account may be worried about having multiple securities accounts used for transactions.

There are many advantages, such as having multiple securities accounts, increasing the probability of winning IPOs and teaching services for each securities company.On the other hand, there are disadvantages such as asset management and the complicated tax return, so prior measures are required.

Unp -listed companies will list new shares on a stock exchange and let investors acquire shares.

This time, we explain the advantages and disadvantages of multiple securities accounts, as well as tips for using wisely.We will also explain how to manage and tax return, so if you read it, you should be able to use it properly.

table of contents

Advantages of having multiple securities accounts

The securities account required to start stock investment.A securities account can have multiple securities companies with multiple securities companies.Securities companies have different commissions and financial products, so having multiple securities accounts allows you to invest in each characteristic.

The benefits of having multiple securities accounts are as follows.

複数の証券口座を持つメリットLet's look one by one.

By having multiple securities accounts, you can teach, for example, a convenient tool for Rakuten Securities, and SBI Securities with a rich investment trust for each securities company.

5 recommended securities accounts for having multiple securities accountsを見るIPO is said to be difficult to win, but it is possible to increase the winning probability by applying from multiple securities companies.IPO is a newly published stock when a company that has not been listed is listed.

IPOs that have a high probability of winning with a win rate of 80%or more in recent years are popular, but you need to win a lottery to get them.If you have multiple securities accounts, you will have a chance to win.

5 recommended securities accounts for having multiple securities accountsを見るIf you have multiple securities companies, you may be able to save a commission.For example, Rakuten Securities and SBI Securities are free of charge for transactions up to 1 million yen per day depending on the plan.

If you have both accounts, you will get a free fee up to 2 million yen a day, so you will be advantageous.

5 recommended securities accounts for having multiple securities accountsを見るIf you use multiple securities accounts, you can see which securities account suits you.

By comparing and examining, the necessary and unnecessary services will be clear.

You can invest more efficiently by maintaining a securities account with the necessary services.

5 recommended securities accounts for having multiple securities accountsを見る4 disadvantages with multiple securities accounts

When having multiple securities accounts, it is wise to understand not only the advantages but also the disadvantages.

複数の証券口座を持つデメリットLooking at the merits, we have opened some accounts, but make sure you check them not to say "I should have left one."

If you have multiple securities accounts, management will be troublesome.

By deciding on your own rules, "This securities account is only for this transaction," you can prevent the complexity and confusion of management.

It is recommended that you identify which usage is easy to manage and get better while using it.

5 recommended securities accounts for having multiple securities accountsを見るThere are a number of securities accounts, causing investment assets to be distributed, resulting in lack of balance when you want to trade, and you have to move funds from other securities accounts, which may lead to labor and time loss. there is.

If you have multiple accounts, you will need to file a tax return depending on the product operation status.For example, a profit and loss can be made by filing a tax return when a loss occurs in one account, and when a loss occurs in another account.

The total profit and loss is to offset the profit and loss within a certain period.If you make an investment in listed shares and make a profit (transfer gains or dividends, etc.), you will be taxed, but if you get a loss, you can subtract from the profit and reduce the tax by that much.

The total profit and loss is to offset the positive gains and negative sales losses obtained from listed shares and investment trusts.

There are three types of securities accounts:

証券口座の種類There is no need to file a tax return for accounts with withholding in a specific account, as the securities company calculates the profit and loss and taxes and taxes and deductes the tax from the sale price.However, if you get a profit in a withholding account with a withholding tax and a loss is issued in another account, you must file a tax return to make a total profit or loss.

A specific account is a system in which a securities company calculates profit and loss instead of investors regarding transfer gains tax on listed shares, which are applicable to taxation separation tax.With the choice of investors, securities companies can pay taxes and investors do not need to file a tax return.

5 recommended securities accounts for having multiple securities accountsを見るThe ID and password are different for each securities account, so it is difficult to manage your ID and password at the time of login.

In the case of automatic login or apps, you can simplify login by using fingerprint authentication or face ID.

However, there are some securities companies that enter the transaction password input at the time of transaction, and when the registration information is changed, the ID and password are entered again.

It is not easy to memorize the ID and password of all securities companies, and it will be difficult to manage even if you leave it in a memo.Because it is a particularly important personal information, it is quite dangerous if you eliminate notes and leak information.

Because it is information that must be managed with a sense of crisis, the burden will increase due to difficult management.

5 recommended securities accounts for having multiple securities accountsを見るA must -see for beginners!How to choose a securities account

Let's take a look at the recommended choices and points when a beginner opens an account.

口座開設のポイントIt is not recommended to open an account "anymore" in terms of management.It is important to think about what kind of transaction you want to do, how to use and hope.

As the name implies, the main account is the main trading and operation, so choose from the commission, functions, and stocks.

Choose a securities account with as low as possible, as the main account is often increased.

Even if you feel insignificant, the higher the number of transactions and the amount, the higher the amount of money.Choose a securities company with as low as possible or a free transaction fee.

The commission that depends on the amount when the transaction is established.There is no commission if the transaction is not established.

In terms of functions, the point is to focus on the ease of use of trading tools, as well as the ease of viewing of the chart, information distribution, etc.

If you are trading mainly on smartphones, check out the ease of use of the app and how much functions are.

In addition, the number and types of stocks are different depending on the securities company.If you are dealing with the brand you want, or if you do not have any particular wishes, selecting a securities company with as many stocks as possible will expand the range of future transactions.

5 recommended securities accounts for having multiple securities accountsを見るWhen choosing a sub -account, check out the commission, handling stocks, and if you want to use IPOs like the main account.

In the case of a sub -account, the transaction volume may not be so large, so choose a securities company with a low commission or a securities company with no commission up to the maximum amount.

In particular, by choosing a securities company with a free commission up to the maximum amount, you can make more deals in terms of comprehensive deals by reducing commissions.

If you want to use IPO, please check the IPO transaction results, distribution, and lottery methods.

The assignments, achievements, and lottery methods may vary greatly depending on the securities company, so let's judge which securities company should open an account or the winning rate is likely to increase.

5 recommended securities accounts for having multiple securities accountsを見るNet securities are increasing, but using face -to -face securities and internet securities properly can make use of each other's goodness.

In the case of face -to -face securities, there is an opportunity to learn directly from instructors and experts, such as a person in charge, seminar and study sessions.

It is suitable for those who want to consult face -to -face and those who want to learn, but there is a disadvantage that there is a high commission for transactions, so let's combine it with online securities with low commissions.

Net securities rarely do something face -to -face.Even if you hold a seminar, most online and video distribution.

You may feel uneasy for those who want to consult face -to -face or want to ask the person in charge who can leave it with confidence.In such a case, use your account according to the merit of face -to -face securities and transactions according to the merits of internet securities.

5 recommended securities accounts for having multiple securities accountsを見るIf you open multiple securities accounts

Once you have decided to open multiple securities accounts, think about the application for opening an account, preparing for identity verification documents, selecting NISA Katsumi Katsumitani NISA, selection of securities companies, and specific accounts.

A small investment tax exemption system where a 1.2 million yen tax -exempt investment slot is set.Dividends and transfer gains of stocks, investment trusts, etc. are eligible for tax exemption.

複数の証券口座についてKnowing the flow and precautions when opening an account will allow you to open a smooth account and reduce the possibility of making a mistake.

If you are worried about which securities company to open an account, you may open a different securities account from your wishes, so be sure to check "your desired securities account".

When opening multiple securities accounts, make sure to make a mistake, such as listing your desired securities accounts or checking your favorite or bookmarks.

If you open an account by mistake, you will have to choose whether to use an account you do not want or to apply an account closing procedure, which will result in a time loss and a burden.

In addition, there is a possibility that the effort and time takes time, such as entering personal information at the time of application and confirming important matters, may be wasted.

When applying for an account opening, be sure to check the securities account you want or whether the content is correct.

5 recommended securities accounts for having multiple securities accountsを見るDepending on the securities company, the type and number of identification documents required are different, but the common thing is "My Number Card or Notification Card".

My Number Card or Notification Card will be required by any securities company, so be prepared.

Others are often required for identification documents, such as driver's license, various health insurance cards, residence cards, and passports.

Not only the necessary documents vary depending on the securities company, but the types of documents required depending on the identity verification method will change.

In many cases, there are few necessary documents in the case of identity verification online, such as smartphones, and the required documents tend to increase when verifying the identity by mail.

5 recommended securities accounts for having multiple securities accountsを見るNISA is divided into general NISA and NISA, but can only have one account per person.You also have to choose one of the general NISA Katsumitake NISA.

Most of the securities companies can apply at the same time when the account is opened, so let's apply together to save time.

First, select whether to make it a general NISA or NISA, then decide which securities company will have an account and proceed to apply.

5 recommended securities accounts for having multiple securities accountsを見るWhen opening a specific account, one securities company is determined to have one account.If you want to have multiple specific accounts, apply at another securities company.

Having multiple securities accounts allows you to have multiple specific accounts, so it is recommended for those who are not satisfied with one specific account and those who want to operate multiple specific accounts.

5 recommended securities accounts for having multiple securities accountsを見るBy purpose!Combination of securities accounts

Let's change the combination of securities accounts according to your wishes and purposes.

目的Here are the standards.Think about what the transaction you want and what you want to focus on, and consider the combination.

If you are interested in foreign stocks, we recommend Monex Securities and SBI Securities, or Rakuten Securities.

Monex Securities has a characteristic that the handling stocks exceed 6,000 brands and the exchange fee is free when purchasing.

SBI SECURITIES has more than 5,000 stocks in US stocks alone, with a fee of $ 0 to 22 (tax included).

Rakuten Securities also has the number of stocks handled by US stocks, about 4,700 stocks, but the minimum commission is $ 0, and the commission is reduced.If you are accumulating Rakuten points, Rakuten Securities is also recommended.

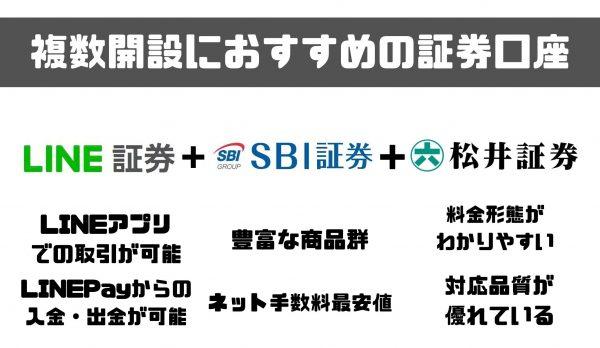

5 recommended securities accounts for having multiple securities accountsを見るRecommended combinations for beginners who want to start investing from small amounts are LINE SECURITIES and SBI Securities.

Normally, Japanese stocks that must be purchased in 100 shares can be purchased from one share (mini shares) as a single share (mini shares).

A single share less than a single unit is a fractional stock that is less than the number of shares of one unit, which is the minimum trading unit determined for each brand.Although the exercise of voting rights at the General Meeting of Shareholders is not allowed, the rights of shareholders, such as other rights claims, copy of documents, and shareholder representative lawsuits, are found.

In the case of a single -unit shares, the risk aspects and dividends vary depending on whether the trading price is reduced, but the hurdle for the purchase is reduced, as well as whether the same stock is purchased for 100 or multiple units of shares.

5 recommended securities accounts for having multiple securities accountsを見るIf you want to focus on IPO, SBI Securities and SMBC Nikko Securities are recommended.

SBI SECURITIES has a large number of handling, 60 % is a complete equality lottery, and 30 % are lotteries with IPO challenge points.The remaining 10 % is a method that SBI SECURITIES is determined by paying attention to the thoroughness of the "conformity principle", such as knowledge, experience, and power of investment.

In order to provide the distribution opportunities fairly for the distribution of new public shares to individual customers, 60%of the scheduled distribution quantity to individual customers will be determined by lottery.For the remaining 30 %, 3.(1) The distribution destination will be determined by the method based on our IPO challenge point specified in [6].For the remaining 10%, paying attention to the thoroughness of the "conformity principle" such as knowledge, experience, and resources (for the application of customers who were not allocated by the above method)., Based on the transaction status with us, we will determine the distribution destination according to the distribution standards set by the Company.

At SMBC Nikko Securities, 85 % are completely equal lottery at stores, 10 % are online complete equality lottery, up to 5 % preferential lottery.

Looking at the number of IPOs in 2021, you can see that 80 SBI Securities handled SBI Securities and 47 SMBC Nikko Securities handled many IPOs.These two companies are recommended considering the results and lottery methods.

However, if you are good at complete equality lottery, choose a securities company with an IPO lottery method such as Monex Securities.

5 recommended securities accounts for having multiple securities accountsを見るIf you want to keep your commissions, or if you want to make it as low as possible, SBI Securities and GMO Click Securities are recommended.Transactions up to 1 million yen a day are free of charge by selecting course.

In the case of transactions of 1 million yen or more, both companies are 1,238 yen for up to 2 million yen and 1,691 yen for 3 million yen.

Rakuten Securities and au Cabecom Securities, which are said to be cheap, cost 2,200 yen for up to 2 million yen and 3 million yen for 3 million yen, so you can see that the SBI Securities and GMO Click Securities fees are low.

5 recommended securities accounts for having multiple securities accounts

From here, we will look at 5 recommended securities accounts for those who want to have multiple securities accounts.Depending on the securities company, there are differences in the characteristics and the contents of the campaign currently being held.

Let's take a look while thinking about whether you can do the transaction you want and which securities companies are suitable.

(引用元:SBI証券公式サイト)| 現物取引手数料(5万円まで) | 55円(税込、スタンダードプラン) |

|---|---|

| 現物取引手数料(10万円まで) | 99円(税込、スタンダードプラン) |

| 現物取引手数料(50万円まで) | 275円(税込、スタンダードプラン) |

| 投資信託銘柄数 | 2,676銘柄 |

| 米国株取扱銘柄数 | 5,002銘柄 |

| つみたてNISA銘柄数 | 176銘柄 |

| 口座開設までの日数 | 最短即日(オンラインでの口座開設時) |

Transactions with your own cash and stock.It is used to distinguish it from margin trading, futures trading, optional transactions, etc.

* As of December 2021 * Quoted: SBI SECURITIES official website

SBI Securities, which have abundant stocks and can open an account in the shortest day, boast the number one domestic stock share share.

Recommended points for beginners include a one -day flat -rate active plan, a point that can be used, purchasing with a small amount of NISA, iDeCo, investment trust credit cards, and easy transactions with smartphones.

In the case of a standard plan, the commission starts from 55 yen (tax included), but by selecting a flat -rate active plan, the transaction fee is 0 yen for a total of 1 million yen per day.

In addition, domestic stock fees are free for young users for users for young people under the age of 25.

The number of US stocks handled is 5,002, 4,677 Rakuten Securities and 1,261 DMM.Compared to COM securities, it is recommended for those who want to use other than domestic stocks and those who want to expand the range of operations in the future.

In addition, if you want to start with a small amount, such as a beginner, or if you are worried about the commission, you can start NISA from a small amount, and the commission is 0 yen for a total of 1 million yen per day depending on the course selection.

SBI Securities, which always carry out campaigns for investment debuts and continuous users, are holding the following two campaigns as a limited -time campaign.

・ハズレなし!当社への投信お乗り換えが超おトクキャンペーンSBI証券へ投信のお引っ越し(入庫)を検討中の方は要チェック!10万円以上の投信のお引っ越し(入庫)&お取引で最大100,000ポイントがもらえるチャンス。キャンペーン期間:2022年2月4日(金)~2022年3月31日(木)

・ If you want to do day trading, use SBI Securities!Have you already experienced a day training in the daily margin trading campaign?Now, if you are an Internet course individual customer who has entered during the target period and has met some conditions for a new building in the general credit "Sunrise Credit Trading", even one day during the period.We will cash back the actual trading fee and margin trading fee according to STEP (the upper limit of 10,000 yen, respectively).Campaign period: Tuesday, January 4, 2022 9: 00- March 31, 2022 (Thursday)

Transactions are made by renting cash, stocks, and investment trusts with a securities company as collateral to borrow money and shares necessary for buying and selling from securities companies.

In each case, there are fees reduction and cashback, so you can trade at a higher price by satisfying the conditions.

SBI証券の口座開設はこちら(引用元:楽天証券公式サイト)| 現物取引手数料(5万円まで) | 55円(税込、超割コース) |

|---|---|

| 現物取引手数料(10万円まで) | 99円(税込、超割コース) |

| 現物取引手数料(50万円まで) | 275円(税込、超割コース) |

| 投資信託銘柄数 | 2,669銘柄 |

| 米国株取扱銘柄数 | 4,677銘柄 |

| つみたてNISA銘柄数 | 179銘柄 |

| 口座開設までの日数 | 1~2週間程度 |

* As of January 2022 * Quoted: Rakuten Securities Official Website

Rakuten Securities has more stocks of investment trusts and US stocks as they are on SBI Securities.

The time to open an account is a little longer, but there is an advantage that you can use the points you have accumulated for the use of the Rakuten Group, or you can carry it up.It is popular for those who use the Rakuten Group and those who want to use points.

By selecting a fixed -rate course, the transaction fee is 0 yen for a total of 1 million yen per day.In this case, the fee will be the same as the SBI Securities' active plan.

Recommended for those who want to keep the commission and those who wish to trade a small amount.

In the case of a super -rate course, you can get Rakuten points according to the commission payment amount, and you can also invest in points using the accumulated points.

Point investment can also obtain Rakuten Group's unique benefits, such as the point magnification of +1 times when shopping at Rakuten Ichiba.

Rakuten Securities also hold many campaigns at all times.There are three recommended campaigns:

・ [19th] Rakuten Bank account opening + Automatic deposit setting will give you 1,000 yen for those who have achieved the conditions during the 1,000 yen gift period.* Target: Thursday, December 30, 2021 10: 00- February 28, 2022 (Monday) Those who have applied for a bank account by 9:59

・ U.S. stock reserve or point investment 2 million points Entered during the campaign campaign period, all customers who have set the first US stock reserve or point investment (US stock_ -yen coin settlement) set up 2 million points.!Campaign period: Friday, January 7, 2022, 10:00 to March 31 (Thursday) 10:00

・ If you start, now you have a chance!100 points gifts instead of the first domestic stock (in -kind) transaction!We will enter this campaign and give 100 points to customers who have traded domestic stocks (in -kind) for the first time.Campaign period: February 7, 2022 (Monday) to March 4, 2022 (Friday) 16:00

Rakuten Securities focuses on point gifts more than cashback campaigns.

楽天証券の口座開設はこちら(引用元:松井証券公式サイト)| 現物取引手数料(50万円まで) | 0円 |

|---|---|

| 現物取引手数料(100万円まで) | 25歳以下(未成年含む):0円26歳以上:1,100円(税込) |

| 投資信託銘柄数 | 1,577銘柄 |

| 米国株取扱銘柄数 | 取り扱いなし(2022年2月より対応予定) |

| つみたてNISA銘柄数 | 172銘柄 |

| 口座開設までの日数 | 最短3日(オンライン申込時) |

* As of January 2022 * Quoted: Matsui Securities Official Website

Matsui Securities costs 0 yen to a total of 500,000 yen for a total of 500,000 yen per day, and 0 yen, regardless of the contract.

HDI-JAPAN sponsored by HDI-JAPAN 2021 Interested (securities industry) has won the highest rating "three stars".Moreover, the point is that it has been acquired for 11 consecutive years.

As the industry's first margin trading, there are indefinite margin transactions and one -day margin transactions.

Indefinite margin trading has no payment deadline, one -day margin trading is a transaction fee of 0 yen, interest rate, and a shareholding fee of 0 to 1.It is a service that can be day traded at low cost at 8 %.

Matsui Securities has a lot of sites, free calls, remote support, etc. as well as sites.

Matsui Securities, which was founded in Taisho 7, has a history of more than 100 years.

Not only that, it is constantly evolving, such as trading methods, handling, and services according to the industry and demand.Recently, we launched a service in 2020 to return a part of the investment trust's trust fees.

Matsui Securities also hold various campaigns at all times.

-The payment debut debut campaign, which hits 50 people every month by lottery, has completed an account and paid more than 10,000 yen by the month following the account opening month, to 50 people every month by lottery.Matsui Securities Points will receive 2,000 points.Campaign period: Friday, January 14, 2022 -March 31, 2022 (Thursday)

・ Supporting the debut!If you open an account in Matsui Securities during the 100 million yen reduction campaign campaign, and you will have a total of 10,000 yen or more, you will receive a total of 1,000 yen or Matsui Securities Point 1,500p to up to 100,000 people.Purchase at NISA / Tsumata NISA, of course, is also eligible.If you make your debut with Matsui Securities, Ima is a good idea!Please take advantage of the great campaign.Campaign period: January 15, 2022 (Sat) -An December 30, 2022 (Friday)

・ 10,000 points to 100 people by lottery every month!From January 4, 2022, 2022, we will hold a campaign to present Matsui Securities Points by lottery for those who have made a business using the smartphone trading application "Matsui Securities Stock App".!From January to March, 100 Matsui Securities Points 10,000 points will be presented to 100 people by lottery of the campaign.In addition, those who have their birthdays for each month will double the winning probability!In November 2021, we have been working on expanding its functions since March 2021, such as extending the validity period of the order to a maximum of one month.Please take this opportunity to try a trading with a stock app!Campaign period: Tuesday, 2022 -March 31, 2022 (Thursday)

In addition to cashback and reduction campaigns, we hold Matsui Securities' unique points and interest rate up campaigns.

Not only when new transactions and account opening, but also for monthly lottery campaigns, you will be able to apply while trading and win.

松井証券の口座開設はこちら(引用元:マネックス証券公式サイト)| 現物取引手数料(~10万円以下) | 110円(税込、取引毎手数料コース) |

|---|---|

| 現物取引手数料(10万円超~50万円以下) | 198円〜495円(税込、取引毎手数料コース) |

| 現物取引手数料(50万円超〜100万円以下) | 成行:1,100円(税込、取引毎手数料コース)指値:1,650円(税込、取引毎手数料コース) |

| 投資信託銘柄数 | 1,241銘柄 |

| 米国株取扱銘柄数 | 5,000銘柄以上 |

| つみたてNISA銘柄数 | 152銘柄 |

| 口座開設までの日数 | 2~3営業日(オンライン口座開設、証券総合取引口座) |

* As of January 2022 * Quoted: Monex Securities Official Website

Monex Securities is a reasonable commission and a fulfilling product.It is an affordable fee in the industry, but it is not cheaper than SBI Securities, Rakuten Securities, and Matsui Securities.

In addition, it is possible to trade in the unit of unit called one shares.The commission at the time of purchase is 0 yen, and the contract price is 0 when sold..55 % (tax included) will be commission.

The number of US stocks handled is large, about SBI Securities and Rakuten Securities.The 5,000 stocks are quite large and are recommended for those who want US stocks.

In addition, US stock fees are at least $ 0, and the minimum commission is 0..The maximum fee is 495 %, the maximum commission is $ 22.

Including domestic stocks recommended for investment debut, US stocks, investment trusts and Tsumat, IPO, ETF, FX, cryptographic asset CFD, bonds, ON Compasses, etc. are available.

Listed on a stock exchange and aims to link to indicators represented by the Stock Price Index (such as "TOPIX)), it is called ETF with the acronym" Exchange Traded Funds ".。

In addition, as a step -up product, it can be said that it is a very fulfilling lineup, including credit trading, futures and options, Chinese stocks, gold, platinum, and private funds.

This is a product in which the money collected from investors is collected as a large fund, and operating experts invest and operate in stocks and bonds.

In addition, if you own an investment trust, you can get Manex points, and points can be exchanged for Amazon gift vouchers.

Monex Securities, which are full of US stocks, has a rich campaign on US stocks.

・ US stock debut support is extended for cashback period and no limit Campaign Securities, "US stock debut support program that cash back US stock trading fees (excluding tax) to support your 2022 US stock trading debut.We will carry out an enlarged campaign to power up.If you have paid for the first time during the campaign period, we will cash back the US stock trading fee (excluding tax) for 40 days from that day.Please consider US stock trading of Monex Securities.Campaign period: February 7, 2022 (Monday) to May 31, 2022 (Tuesday)

There are many campaigns that do not require entry, so you may be able to apply for the campaign automatically.Of course, there are half the entry required campaign, so check it out when you apply.

マネックス証券の口座開設はこちら(引用元:LINE証券公式サイト)| 現物取引手数料(5万円まで) | 55円(税込) |

|---|---|

| 現物取引手数料(10万円まで) | 99円(税込) |

| 現物取引手数料(50万円まで) | 275円(税込) |

| 投資信託銘柄数 | 32銘柄 |

| 米国株取扱銘柄数 | 取り扱いなし |

| つみたてNISA銘柄数 | 取り扱いなし |

| 口座開設までの日数 | 最短翌営業日 |

* As of January 2022 * Quoted: LINE Securities Official Website

LINE Securities is a securities company unique to LINE, where basic operations can be completed on LINE.Not only information distribution and notifications, but also LINE Securities can be traded in LINE apps and trading such as stock prices and orders.

It is also possible to trade from one share called Ichikabu, so it is recommended for those who feel uneasy in terms of funds and beginners who want to start with a small amount.

With LINE's unique services enhanced, LINE Pay deposits and LINE POINT can be deposited.LINE POINT can also be used for fresh investment, so it is also recommended for those who have extra points.

The commission is quite low, like the SBI Securities Standard Plan and Rakuten Securities's super -rate courses.It is suitable for those who want to use intuitively, those who want to trade even if they are not dedicated apps, and those who want to make the commission as low as possible.

It can be invested from at least 100 yen as a spot investment, and can be invested from 1,000 yen per month even monthly.I can start with a small amount and lower the hurdle for investment and freshness.

If you want a full -fledged stock trading, let's trade stock in 100 shares in the actual trading.It is recommended not only for beginners who want to start with a small amount, but also for those who wish to trade in earnest.

At LINE Securities, you can get up to 3,000 yen equivalent to the quiz when opening a securities account.If you answer the quiz correctly, you can choose which stock you want to use and operate the stock.

You can sell it on the spot and use it for other purchase funds, or it is also recommended to keep it and learn about the operation of stocks.

In addition, a campaign is also held for up to 30 days after opening an account, where Ichikabu transaction costs (for group A brand only) are 0 yen.Recommended for those who trade for the first time.

LINE証券の口座開設はこちらIf you have multiple securities accounts, what will happen to your final tax return and profit and loss?

If you have multiple securities accounts, you do not always need a final tax return, but in some cases you will need a tax return.It is at the time of profit and loss.

証券口座を複数持つ場合The above is important, so let's know in advance.

The total profit and loss is to calculate "actual profit and loss" by combining profits and losses.For example, if one securities account can make a profit, and if there is a loss in another securities account, the appropriate tax can be calculated by combining it.

20 for profit.There are 315 % taxation, but you can get over -paying tax refunds by profit or loss.

This profit and loss can be used when you have multiple securities accounts and can be refunded by tax returns, which may result in a profit.

5 recommended securities accounts for having multiple securities accountsを見る税金の控除を受けるためには確定申告が必須です。20 for profit.315 % tax will be a specific account, and the securities company will give you the tax amount.

However, securities companies do not apply for tax deductions or multiple securities accounts.

In particular, the deduction of the loss of loss is quite possible for those who have a securities account or those who use it.The final tax return may feel troublesome, but be sure to apply.

5 recommended securities accounts for having multiple securities accountsを見るLet's know about the final tax return

In the first place, there are many people who are not sure what a tax return is for the first time.

確定申告についてIt is important to know the final tax return for those who have a securities account and have a must -have patterns that are not necessary in a specific account, and the documents required at the time of application.

If you are investing in shares, you need a final tax return in principle.However, by selecting withholding in a specific account, the securities company deducts taxes, so you will not need a final tax return.

20 for profit.With 315 % of taxes, if you choose without withholding of general accounts or specific accounts, you will need to file a tax return and pay taxes.

Many people find it troublesome to file a tax return, and the withholding tax of specific accounts is gaining popularity.

Since securities companies also recommend the withholding of a specific account, if you do not have multiple accounts, you will not need to file a final tax return.

5 recommended securities accounts for having multiple securities accountsを見るIf you do not need a tax return, you can divide it into two patterns.

確定申告が必要ない場合These two patterns do not require a final tax return.The NISA account is tax -exempt in the first place, so even if you have a profit or loss, you will not be eligible if you want to make a total profit or loss with multiple securities companies.

In addition, there is a withholding tax of a specific account..Since 315 % of taxes are deducted, you do not need a final tax return if you have one securities account.

5 recommended securities accounts for having multiple securities accountsを見るWhether a declaration is required depends on the type and number of accounts.

確定申告が必須の場合If you do not want to file a final tax return, it is recommended that you select the withholding tax of a specific account and use one securities account.

However, you can receive tax deductions by tax refund or carried forward deduction by filing a tax return.

It may seem troublesome, but it can be said that it is a privilege that can be used because it has a securities account.

5 recommended securities accounts for having multiple securities accountsを見るThe required documents at the time of tax return depend on the division of the trading account.The required documents are as follows.

特定口座 一般口座At the time of application, you will need withholding slip such as public pensions and certificates for payment insurance premiums, so be prepared in advance.

Previously, we submitted annual transaction reports and payment notices, but have been changed to unnecessary attachments from April 1, 2019.However, it is necessary to create an application document just because it is no longer necessary to attach it at the time of declaration.

5 recommended securities accounts for having multiple securities accountsを見るLet's operate well by having multiple securities accounts

Having multiple securities accounts can be reduced and maximize the characteristics of each securities company.

複数の証券口座の運用についてYou may find it difficult to manage your ID, password, and assets, but you can make smooth transactions even if you increase your account by deciding your own rules and standards.

Even if you select with withholding in a specific account, you may need to have withholding by having multiple accounts.

Total income and carryover deduction must be tax returned, and tax refunds will not be made unless you declare.You will need to check if you are subject to the final tax return.

Understanding the benefits of each securities company, opening and using an account, can be more profitable than operating in one securities account, increasing the winning rate of IPOs.

If you are worried, consider increasing the number of securities accounts at this opportunity.

5 recommended securities accounts for having multiple securities accountsを見る証券口座を複数持つ場合のよくあるQ&A

If you are worried about having multiple securities accounts, or do not know what is good, resolve questions from frequent questions.

証券口座を複数持つ場合のQ&AHere are seven questions that many people are wondering.If you are thinking of opening an account, if you already have one account but are worried about the increase, check it out.

Basically, multiple specific accounts cannot be opened in the same securities company.A specific account is opened up to one account for one securities company.However, it is possible to open a specific account and a NISA account, and open a specific account and FX account.

If you want to have multiple specific accounts, change the securities company and open an account.By changing the securities company, there are no restrictions on the number of specific accounts and other accounts.

In the case of "the same securities company", remember that there is only one specific account.

The benefits of having multiple accounts include a great deal of commissions, increasing the winning rate of IPOs, using the characteristics of each securities company, and finding a securities company that suits you.

Depending on what kind of transaction you want to do and what you value, what securities companies to choose, and how to combine them.

If you want to make the commission as low as possible, choose multiple securities companies with a fee of 0 yen up to a certain amount.By having three types of accounts with a commission of 0 yen up to 1 million yen, you can trade for a commission of 0 yen up to a total of 3 million yen.

Because the characteristics and strengths differ depending on the securities company, such as the IPO lottery method, you can compare and examine the characteristics of each securities company by having multiple accounts and actually using it.

The disadvantage of having multiple securities accounts is that management is difficult and that you need a final tax return.

IDs and passwords are issued for each securities account, but having multiple securities accounts makes it difficult to know which ID is in which ID is, and it is difficult to manage notes and updating information at the time of change.It can be considered.

Since assets are easily dispersed, it is difficult to trade with a sense of speed and may feel difficult.

In addition, having multiple accounts may require a final tax return for profit and loss or deduction.In the total profit and loss, you can apply for a tax refund for too much payment, including the interests and losses of your accounts.

The deduction of carryover can carry over the loss when a large loss occurs, and the income is increased, resulting in a reduced tax payment.

The total profit and loss and the deduction of carryover can receive a refund or tax deduction by tax return, but it is a disadvantage for those who feel troublesome.

General NISA and NISA have to choose one of NISA, and securities companies can only open an account with one company.This is because it is determined that "NISA account is up to one account per person".

If multiple securities companies have applied for opening a NISA account, opening an account will be canceled by the tax office screening.

Even if you try to open both the general NISA account and the NISA account, you will not be able to pass the screening, so do not forget the "one account per person", which securities account will be opened, or the general NISA Katsumitamita NISA.Please consider.

If you have multiple securities accounts, choose a securities company after considering the transactions you want and the points you value.

For example, if you want to lower the commission, check the securities company with a low commission, and if you want to increase the IPO winning rate, check the IPO achievements and lottery.

The benefits, deals of deals, and increased winning rates only depends on how you combine them.

First, let's compare what you want to focus on, and where the securities companies that meet the points you want to focus are.

There are five recommended securities accounts:

おすすめの証券口座The low commission, IPO lottery method, campaign, etc. are substantial, so you can combine them in this.It is also recommended that you use one of these five of these five as the main account and make other interesting securities accounts a sub -account.

As I introduced as a recommendation, the functions, features, and desired transaction methods are different for each individual, so please check it out that it suits your wishes.

If you have multiple securities accounts, you may need to file a final tax return for a total of profit and loss or deduction.However, having multiple accounts does not always require a tax return.

If it is one account, you will not need a tax return by selecting withholding with a specific account.

However, if you select the withholding tax of a specific account, there are multiple accounts, and if the account varies, you will need to file a tax return.

It is important to note that you will not be able to receive a tax deduction by refund or carried forward deduction by profit and loss, so you will not be able to receive it without a tax return.

* The information described in this article will be as of January 25, 2022 unless it is listed individually.Please check the latest information on each company's official home page when opening an account or using a campaign.

| 関連記事 |

|---|

| ・米国株(アメリカ株)初心者におすすめ!ETF投資のメリットを解説・NISAにはデメリットはないのか?注意点や非課税期間終了後の扱いを解説・つみたてNISAでの投資でおすすめ銘柄は?メリット・デメリットも紹介・SBI証券と楽天証券 主要ネット証券2社のメリット・デメリットを比較・手数料・銘柄数・NISA対応で比較!ネット証券のおすすめランキング |