Prices are higher than the conventional outlook, the Bank of Japan is analyzed, and the oil is soaring -the people concerned

(Bloomberg): The Bank of Japan believes that the cost of consumer prices will be more likely to be upwards than in January, following the rising oil prices due to the invasion of Ukrainian military in Russia.He is increasingly vigilant as a risk of pushing the Japanese economy through rising costs.Interview with multiple stakeholders.

According to the officials, depending on the trends in energy prices such as gasoline and electricity bills, consumer prices may temporarily reach 2 % of the target after April, when the price reduction of mobile phone communication charges falls.It is thought to be.However, the rise in prices due to cost is poor, and it is not a situation to discuss monetary easing like the US and European central bank.

With the tensions of the Ukraine situation, crude oil prices have soared from about $ 85 at the time of the previous January monetary policy meeting to about $ 110 at their feet.The government has held a relevant ministerial meeting on April 4 with a soaring oil price, and has decided to expand drastic changes in subsidies paid to the oil source selling company from 5 yen per liter to 25 yen.。

According to the view of the economic and price situation in January (prospect report), consumer prices (core CPI, excluding fresh food) in 2022.1 % rise (conventional 0).It was revised upward to 9 %).The next view report will be announced in April.

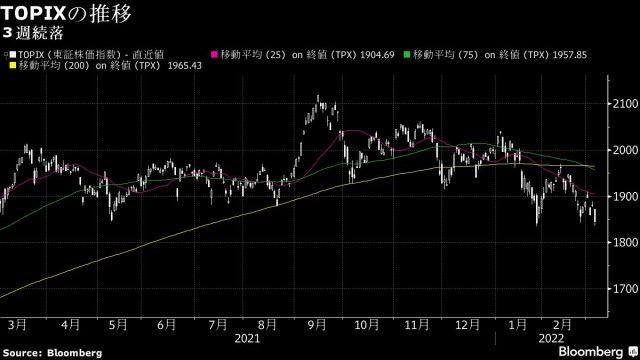

According to the officials of the Ukraine, it is not possible to deny the possibility that the price of crude oil prices will rise or stop further, and will decrease the economy, mainly for personal consumption at the next meeting held on the 17th and 18th.It can be a debate.At the last January decision meeting, the Bank of Japan raised the economic summary to "recovering".

In response to the rapidly expanding of the infection of Omicron strain this year, the personal consumption of the Japanese economy was stalled again at the end of last year.Exports and production have been weakened due to supply constraints such as suspension of domestic factories.