Questions about the Bank of Japan's prices

The first monetary policy meeting of 2022 was held from January 17 to 18.Regarding the long -term interest rate operation (yield curve control), it was 8 oppositions, and the asset purchase policy was unanimous and decided to maintain the current policy.

It was Kataoka Detective Committee member who opposed the yield curve control.Mr. Kataoka opposed it from the viewpoint of supporting the positive capital investment of companies over the corona, and it is desirable to strengthen monetary easing by reducing long and short interest rates.

The term of this committee member of Kataoka was July 23, 2022.The term of Suzuki's committee member is also on the same day.This successor personnel is also interesting.

The decision meeting result was as expected by the market.In the market, attention was focused on prices for prices in the observation report rather than the results of the meeting.

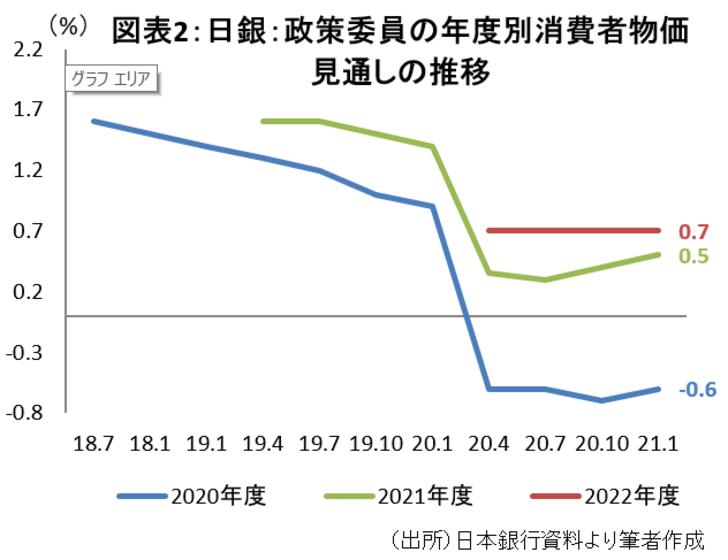

According to the observation report, the median of the consumer price index (excluding fresh) for 2022 is compared to the previous year..1%and the previous October plus 0.It was raised from 9%.

According to the observation report, the consumer prices (except fresh) year -on -year, although the effects of lowering mobile phone communication charges were reduced, it was a small positive, reflecting the rise in energy prices.

The consumer price index in November (freshly fresh) was positive year -on -year..It was 5%.Except for reducing mobile phone communication charges, it will be around 2%.However, excluding temporary factors such as Go to Travel Business 1.It is around 5%.In the future, there will be no temporary effects on the Go to travel business, etc., and will not be reduced in mobile phone communication charges from April.

It is expected that crude oil futures prices will continue to rise, and it is possible that the contribution contribution of energy prices will increase in the future.However, the Bank of Japan predicts that the contribution contribution of energy prices will decline.

The tolerance of household budgets has been gradually improved, reflecting the rise in wage rise, but the price increase of food items is already planned without waiting for it.There are some fare prices, and electricity rates will continue to rise until around February.

Furthermore, as pointed out in the observation report, it is expected that the price setting stance of the company will gradually become more aggressive, which will increase costs and increase prices.

Is it difficult to think that the consumer price index (excluding fresh) will reach 2%in the future?

The Fed has cut off the term price rise from the statement.ECB Deputy Governor Deglindos has stated that the rise in the Euro area is not as temporary as expected.

The Bank of Japan announced the corporate price index 8 year -on -year in December..The high level is maintained at 5%.The 2%consumer prices year -on -year seem to be rather realistic.