Save 33.2% on lunch costs, bring a water bottle 25.2%... Contents of salaried workers' pocket money defense strategy

The top way to save money is to cut lunch costs.

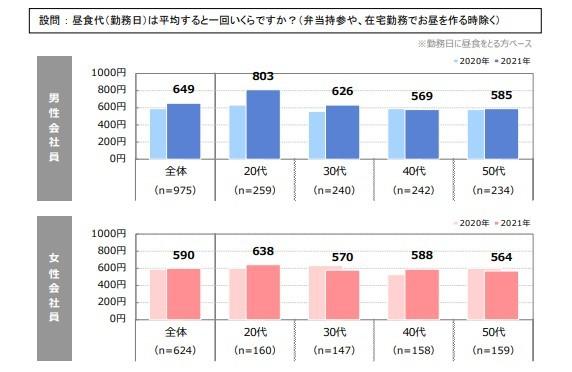

For many salaried workers, their pocket money is the most familiar, and it is a financial issue that affects them greatly. If that allowance falls short of what you want, you will find ways to save money. This time, from the 2021 edition, which is the latest version of the fixed-point observation report "Salaryman's Pocket Money Survey" (*), which is announced every year by Shinsei Bank, the actual situation of salary defense strategies for office workers to confirm.

According to this report, the most recent average salary for salaried workers is 38,710 yen (monthly), which is a decrease compared to last year.

Individuals have their own sense of money and consumption, but there should be quite a few people who are short of this amount. Considering how much you can leave in surplus funds that can reflect your free will to a certain extent after deducting lunch expenses and mobile phone charges, which are close to necessary expenses, everyone should be convinced.

"I don't have enough money, I can't turn my head". At that time, what kind of ingenuity and savings are used to achieve "pocket defense"? Overall, over 70% of people are making ends meet.

The next figure is a graph of the top items by age group, limited to those who are making ends meet. Overall, and in each stratum, the most common response was “lunch cost”, with around 40%.

The saving rate for lunch for people in their 40s is 35.8%, which is higher than other age groups. Does it mean that many people pay attention to the cost of lunch, which they spend on a daily basis, because their expenses add up?

The next answer was "Bring a water bottle" with 25.2% overall. Low in the 20s, high in the 40s. The reason why the price is higher than the same “bring your own lunch” (although “bringing your own lunch” is more expensive for people in their 20s) is probably because it is easier to prepare a lunch than to make it or have it made for you. It is surprising that people in their 30s show the highest value for "Bring a lunch box", but since the rate of marriage is high and there is a high possibility that they have children, they are asked to make lunches for their children together. There will be many opportunities.

23.9% of people answered “how often to drink (reduce)”. For office workers, like lunch, it is one of the few places to relax and take a breather, so it must be very painful to have to reduce it.

20.3% overall said they would avoid impulse purchases, but 24.3% were higher among those in their 50s. Try to save as much as possible the act of receiving a service or purchasing a product with a little momentum or momentum. Considering that the more people who usually make impulse purchases, the more likely they are to hold back or stop making impulse purchases, the more effective it is to protect their pocket money, it makes sense that many people would choose it as an effective means. The low prices for people in their 20s may be because they have given up on impulse purchases.

What if saving money isn't enough?

I have a lot of expenses, or I want to spend something, but saving money just isn't enough. If so, how are you going to raise the money? The answer that most people agreed with among the salaried workers was "don't use it". A little more than 60% of the respondents answered, "When my allowance is not enough, I endure it and do not use it."

"Put up without using" showed an increasing trend a few years ago when business sentiment worsened. In terms of pocket money, it can be said that the situation was more like a "gama (n) retireeman" than a "salaryman." Furthermore, there is no difference that even in recent years when it has turned to a decrease, it shows a much higher value than other items. And there are signs of an increase again in the next year or two.

The next most common is "withdrawal of deposits and savings" and "spending money from household finances". It depends on the reason for the shortage, but if it is a temporary expense or a shortage due to an unexpected event (for example, an invitation to a friend's wedding), it can't be helped.

From the 2013 survey, "additional income" (point site, stock investment, FX, internet auction, etc.) was 8.2%. It is impressive that there are unexpectedly many things that can be put out. This is because these means do not necessarily provide “income”. Rather, it is quite possible that the allowance will be reduced further.

The following graph shows the changes over time for the top ranks of this method and items of interest.

However, in the medium term, the number of other methods of lending, such as "withdrawal of deposits and savings," "withdrawals from household budgets," and "use of credit cards," decreased, but in the past few years, "withdrawal of deposits and savings" turned to increase. ing. On the other hand, after a large increase from 2011 to 2012, “endure without using” has mostly remained at a high level. The year 2011, when this rise began, was the year after 2010, when the amount of pocket money dropped sharply, and it shows that there was a big change in the mindset of salaried workers in response to the large reduction in the actual amount of pocket money. Specifically, it's like saying, "It's not a manageable amount, so let's give up." In addition, it is worrisome that there is a movement of increase in the last one or two years. The increase in the consumption tax rate and the spread of the new coronavirus have led to a shortage of pocket money, but there may be an increasing number of cases where people endure because there is nothing they can do about it.

It is possible to think that patience in spending can prevent wasteful spending, but at the same time stress builds up. I don't mean to encourage overspending, but the fact that nearly two-thirds say "I'll endure if it's not enough" is at a level where it's hard to judge whether it's healthy or not. From a different point of view, if this value drops to the 50% level of 2010, should we expect to see signs of improvement in the salary situation of salaried workers? Alternatively, there may be a big change in the mood of office workers themselves, and this value may be semi-fixed at this level.

■Related articles:

[10 points to save money in your daily work]

[Introduction of Premium Friday is 3.3% ... Explore the actual situation of penetration of work style reform to office workers (2019 edition)]

*Salaryman's pocket money survey

The most recent year, 2021, was conducted via the Internet from April 16 to 19, 2021, with 2,718 valid responses. In addition to male and female office workers (regular employees, contract employees, temporary employees), male and female part-time workers are also included. According to the published materials, 1252 male and 842 female employees account for the majority. The composition ratio by age group is almost evenly distributed in 10-year divisions from 20s to 50s (Since weight back based on the actual number of employees is not applied, the overall value shows a bias compared to the actual social situation. sometimes). The unmarried/married ratio is 40.2 to 59.8 for men and 59.5 to 40.5 for women. The current survey has been conducted on a fixed-point basis since 1979, but it should be noted that the same people are not surveyed every year.

(Note) Unless otherwise specified, the graphs and charts in the text are quoted from or created by the author based on the materials.

(Note) Unless otherwise noted, the photographs in the text were created by the author based on the materials described in the text, or were taken by the author during interviews.

(Note) Numbers used in article titles, text, graphs, etc. may be written after rounding off any digits after the decimal point so that the display is considered optimal on the spot. I have. Therefore, the total number of figures on the display may not match exactly.

(Note) If the value at the end of the axis of the graph is set to a positive value other than zero in order to fix the appearance of the graph and make it easier to see the movement of the numbers, the value is enclosed in a circle or the like to call attention to it. There are cases.

(Note) In order to improve the appearance of the graph, the notation of items (such as okurigana) may be partially omitted or changed. Also, "~" may be expressed as "-".

(Note) "ppt" in the graph means % points.

(Note) "(Great) Earthquake" refers to the Great East Japan Earthquake unless otherwise specified.

(Note) This article is a partial addition and change to the article published in [Garbage News].