Where are the recommended securities companies that can have mini shares (shares under units)?Introducing the hot -featured mini stock!

Speaking of stock investment, you need a large amount of money, and you may have the image of a chart and glaring of corporate information, but in fact there is a stock investment that can be easily started from a small amount of several thousand yen.That is a mini -stock that can become a shareholder from one share.This time, we will introduce securities companies recommended for mini shares and stocks that are hot.

関連記事What are mini shares and units of unit?

In the first place, what kind of shares are mini -shares and shares less than the unit?

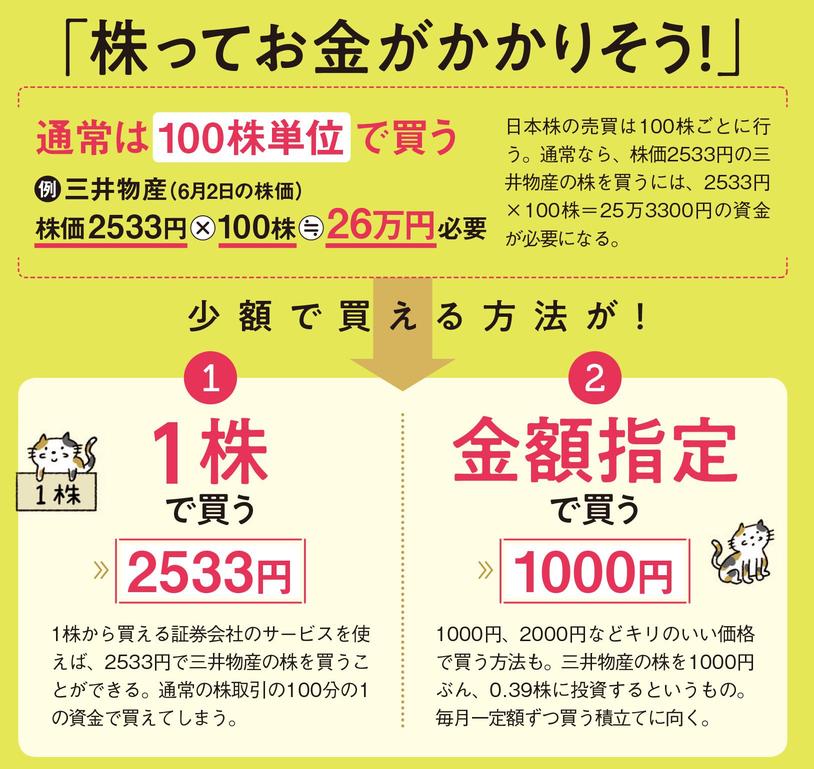

I think that the first thing that you think of investing is "stock investment", but in fact company stocks are usually traded in 100 shares.However, this costs dozens to millions of yen to buy one company's stock, making it difficult for beginners to invest.For mini -shares and shares under the unit, you can trade shares in units less than 100 shares.

Mini shares and shares in less than unit unit are services provided by securities companies, and you can purchase shares from one share.

In the news and newspapers, we see the stock price of the company, such as "Toyota Motor: 2,320 yen per share", but stocks are usually traded in "unit shares" instead of one share.

A unit stock is a trading unit that is sold in normal stock transactions.The unit can be determined freely by clearing a certain rule, so the number of shares varies depending on the stock, but one, 100, and 1,000 shares are generally.However, buying and selling units of listed companies, which were once different, are gradually consolidated in consideration of the convenience of investors, and are now unified to 100 shares.In normal stock transactions, transactions are performed at the integer of this trading unit.Buying and selling is 100, 200, 300 shares, and 100 shares, and cannot be traded in the number of shares other than the unattractive multiples, such as 150 shares.

However, some securities companies provide services that can purchase shares even for the number of shares that are less than the unit of unit.

For example, in stock mini investments (commonly known as mini shares), you can buy and sell shares in one -tenth (10 shares) of a unit, and in the service of a single shares, you can purchase shares from one share.

Society of shares under the unit may be provided by securities companies under service names such as "Ichikabu", "S -shares", and "Petit stock®︎".The mini stock was originally a service that can be traded in one -tenth of a unit, but with the diversification of these units of shares, the mini shares are now one of them, that is, in the same sense as the unit of unit.It has become common to be used.This article also introduces the transaction of shares under a unit share as a "mini share".

Recommended points for mini shares

Is there anything good if you can buy a small stock from a small amount?

Originally, you can become a shareholder of a company that costs one million yen, but you can buy stocks from one company from a small amount to expand your investment method.

What are the benefits of mini -shares that can purchase shares under a single share compared to transactions in the unit stock?

The first advantage of mini -shares is that the hurdle for stock investment is low.For example, if you want to invest in a company with a stock price of 2,000 yen, it will be difficult to start casually because it requires 2,000 yen x 100 shares = 200,000 yen.

However, mini shares that can be bought from one share can start investing in stocks for 2,000 yen, the price of one share.

Even if you don't have stocks, you can see corporate information or study charts, but after all, those who actually have a company stock will deeply examine the company's performance, seriously in stock prices.Understanding about stock investment, such as making predictions, should deepen.

In this way, it is one of the great attractions of mini shares that you can experience the actual stock investment with less funds.

In stock investment, it is important to invest in multiple companies as much as possible.Because only one company's shares will increase the loss when the company's performance drops sharply, and if the company goes bankrupt, the stock that has it is just out of paper.Because it will be.

However, it would be difficult to invest in multiple companies in a transaction with a single company that costs decades to several million yen.

Mini shares are also advantageous in this distributed investment.If it costs 10,000 yen, it can be distributed into a few companies, and if it is 100,000 yen, the range of distributed investment will expand considerably.

Even if the shares you hold are less than the unit, the dividends can be received according to the number of shares.However, there is no management right to participate in the general meeting of shareholders.

In many cases, shareholder benefits are not received, but some companies may provide shareholder benefits even under the unit.If one of the purposes of stock investment is shareholder benefit, if you find a stock you care about, contact the company.

Points that are not recommended for mini shares

Are there any disadvantages for mini stocks?

Since stocks are originally traded in monetary strains, transactions under the unit share are not directly performed by investors in the trading market, but securities companies are intervened.As a result, it is different from the transaction of the unit stock, so it is important to understand those differences well.

Since the principle of stock investment is to buy and sell in a unit stock, there are some points to note about mini shares.

In normal unit stocks, you can buy and sell freely within the trading hours of each exchange, and you can also trade with the right price and sell price.However, there is a difference between securities companies, but mini shares that cannot be traded directly on exchanges cannot determine the timing of buying and selling themselves.

For example, SBI SECURITIES mini shares (S shacks) are determined to be three times at 9:30, 12:30, and 15:00.

Please note that it is not always possible to buy and sell at the price you want.

The advantage of mini -shares is that you can invest from a small amount, but if the investment is small, the commission will be expensive.

For example, if the commission is 100 yen, if the fee for buying the stock for 100,000 yen is 100 yen, the ratio is 0..Although it is 1 %, if you pay a 100 yen fee for a trading of 1,000 yen, the ratio will be 10 %.

If you make a profit of 100,000 yen for 100,000 yen asset management, and to operate 1,000 yen and make a profit of 100 yen, the latter will naturally increase.When investing in a mini -stock, pay attention to the commission for each securities company.

Mini shares are not the original investment method of stock investment, so it is not possible to trade all stocks that can be traded, and you need to purchase them in stocks determined by securities companies.

The types of brands that can be purchased vary greatly for each securities company.For example, SBI Securities can buy and sell all stocks listed on the Tokyo Stock Exchange in mini -stock trading, but LINE Securities are about 1,500 stocks.

LINE Securities can trade more than 1,500 stocks, including large stocks, small and medium -sized stocks, and emerging market stocks, with "Ichikabu (Less than STA)".

If you have a brand you really want to buy, make sure that the securities company trying to open an account is dealing with the brand.

Recommended securities companies that can trade mini shares

Where can I buy a mini stock?

To start stock investment, you need to open an account at a securities company.In the case of mini shares, a securities account is required for buying and selling, but some securities companies do not handle mini shares, so first check if there is a mini -stock service on a securities company website.On top of that, it is important to choose a securities company that suits you, comparing fees and stocks.

As described above, buying and selling stocks is, in principle, because some securities companies do not handle mini shares.Here are eight recommended securities companies that can be invested in mini shares.

| 証券会社名 | 取引手数料 | 取扱銘柄 | おすすめポイント |

| LINE証券の口座開設はこちら | 0.2〜1.0%のスプレッド | 1,500銘柄以上 | 株のタイムセール |

| Click here to open an account for SBI Neo Mobile Securities | 無料 | 東証上場銘柄 | サービス利用料定額Tポイントで投資可能 |

| SBI証券の口座開設はこちら | 買付:実質無料売却:約定代金の0.55% | 東証上場銘柄 | ミニ株買付手数料実質無料 |

| PayPay証券の口座開設はこちら | 0.5%〜1.0%のスプレッド | 日米約300銘柄 | 1,000円で株に投資可能 |

| auカブコム証券の口座開設はこちら | 約定代金の0.55% | 東証・名証上場銘柄 | ミニ株で積立可能 |

| マネックス証券の口座開設はこちら | 買付:無料売却:約定代金の0.55% | 東証・名証上場銘柄 | ミニ株買付手数料無料 |

| SMBC日興証券の口座開設はこちら | 0.0〜1.0%のスプレッド | 東証上場約3,700銘柄 | dポイントで投資可能 |

| 岡三オンライン証券の口座開設はこちら | 220円〜 | 東証・名証上場銘柄 | アナリスト情報が豊富 |

The first feature of LINE Securities is that there is no need to install a new app for investment.According to the Ministry of Internal Affairs and Communications announced by the Ministry of Internal Affairs and Communications in August 2021, 90 % of the Japanese have already used LINE, according to the "Survey Report on the Use Time and Information Behavior of Information and Communications Media in FY2011."In LINE Securities, you can start investing just by tapping the "LINE Securities" icon from the LINE you always use.

The lowest hurdle for those who want to start investing can be said to be the lowest hurdle because they can be invested easily during the gap time.

| ミニ株の名称 | ひとかぶ |

| 手数料 | 片道0.2%〜1.0%のスプレッドが発生 |

| 約定 | リアルタイム約定 |

| 取引時間 | 日中取引:9時〜11時20分、11時30分〜12時20分、12時30分〜14時50分夜間取引:17時〜21時 |

| 取扱銘柄 | 1,500銘柄以上 |

LINE Securities is attractive because one app can be completed from opening an account to stock trading.

First of all, when opening an account, you do not need to exchange troublesome documents, and you can trade from the next business day by simply taking a photo of your identity verification documents and face photos with your smartphone.

In addition, you can check the news and performance information that is useful for selecting a brand, analyst evaluation, as well as shareholder preferential information and dividend information on the application, and you will reach the LINE that you always use.

Of course, stock trading can be done on a smartphone, and the screen is intuitive and simple.Even those who have no time to invest at home will be able to start investing by using travel time and lunch break.

The actual transaction fee is 55 yen or less for 100,000 yen or less for the contracted fee of 50,000 yen, and as of January 2022, along with the SBI Securities Standard Plan and Rakuten Securities Super Discount Course.It is the lowest in the industry.

In addition, there are many unique campaigns, such as "stock time sale" that can buy stocks equivalent to several thousand yen for 0 yen for 0 yen and quiz correct answer.It's an attractive point.

Beginners of investments because most people use the LINE apps on the securities page, can purchase stocks from one share, and to open accounts and campaigns for free.It is a very reputable securities company to start stock investment.

The number of stocks that can be traded is more than 1000 brands and less than a major securities company, so if you get used to it, you may want to compare various stocks with other securities companies.

LINE証券の口座開設はこちら (画像=SBIネオモバイル証券公式HPより引用)SBI Neo Mobile Securities is the first securities company in Japan to invest in T points.When you start investing in stocks and FX, you can use the T points you have accumulated in meals or shopping.In addition, you earn 200 points for Neomova limited T points every month.

Since stocks can be purchased from one share, even those with small investment funds can easily start investing in stock by using the T -points and Neomova limited T points accumulated in shopping.

| ミニ株の名称 | S株 |

| 手数料 | 無料※ |

| 約定 | 東証:1日3回(前場始値、後場始値、後場終値)名証、福証、札証:1日2回(前場始値、後場始値) |

| 取引時間 | 24時間注文可能 |

| 取扱銘柄 | 買付:東証上場銘柄売却:東証、名証、福証、札証上場銘柄 |

* Separate service usage fee is 220 yen per month (in the case of monthly stock transactions, the total amount of 500,000 yen or less) occurs.

In general, stock transactions are charged for each transaction, but SBI Neo Mobile Securities does not charge for each transaction.Instead, service usage fees are incurred on a monthly basis, and if the total amount of domestic stock contracts per month is 500,000 yen or less, it is 220 yen.In other words, you can trade as many times as you want for 220 yen per month (if the total transaction is less than 500,000 yen).

SBI Neo Mobile Securities is not only mini -shares that can invest a small amount.For example, you can apply for an IPO stock that can be expected to rise with a high probability from one share, so anyone can easily participate.

Furthermore, if you set the stocks, specified date, amount, etc. you want to purchase in advance, the SBI Neo Mobile Securities automatically place orders so that you can purchase stocks on the specified date every month.It is also a major feature that you can buy stocks with a sense of funding from 100 yen.

You can start investing with T points that you usually accumulate in regular shopping, and there are many types of investments that can be started with a small amount of stock investment, IPO, stock reserve, and FX, so people with low investment funds will experience investment.Is a perfect securities company.

It seems to be highly evaluated in that it can be invested with T points and the app is easy to use, and you can see the status of the stock you have.SBI Securities can also invest T points for investment, but since the target is investment trust, SBI Neo Mobile Securities will be more advantageous for those who want to start investing in a small amount of stock.

In addition, the service fee costs 220 yen per month, but since Neomova limited T points are given 200 points per month, it is well received in that transactions up to 500,000 yen can be traded for 20 yen per month.

However, it seems better to use a tool of other securities companies for analysis tools for stock information.It is a pity that it does not support the NISA account, especially in small investment.

Click here to open an account for SBI Neo Mobile Securities

(画像=SBI証券公式HPより引用)SBI Securities is the most popular online securities and is the largest securities company in the industry that is always at the top of the number of accounts.Popular secrets are the lowest in the industry and the number of products handled.

The criteria for choosing a securities company vary from person to person, but there is no doubt that the abundance of fees and products handled is an important factor for everyone.SBI SECURITIES, which keeps the industry's highest level, will continue to be a popular securities company in the future.

| ミニ株の名称 | S株 |

| 手数料 | 買付:実質0円※売却:約定代金×0.55%(最低手数料55円) |

| 約定 | 東証:1日3回(前場始値、後場始値、後場終値)名証、福証、札証:1日2回(前場始値、後場始値) |

| 取引時間 | 24時間注文可能 |

| 取扱銘柄 | 買付:東証上場銘柄売却:東証、名証、福証、札証上場銘柄 |

* The purchase fee will be refunded in full cash around the end of the month following the transaction.

SBI SECURITIES is the highest in the industry, with low commissions and abundant products, but providing information for corporate analysis.In particular, the stock analysis tool of the Japanese stock investment, "Takumi," provides a wealth of information such as the settlement news and financial analysis, and can provide detailed corporate analysis for ordinary investors.

You can order mini -shares 24 hours a day, so you can analyze the information until you are satisfied without worrying about time.However, since the contract is three times a day (twice a day except the Tokyo Stock Exchange), it is important to note that there is a time difference between the order and the contract.

One of the most happy SBI securities mini -shares is the transaction method called "Theme Killer (Theme Investment)".This is a trading method that allows multiple companies to invest in multiple companies simply by choosing a topical theme such as "autonomous driving", "artificial intelligence (AI)", and "health care (health)".。

As the recommended point of mini -shares, we can make a small amount of diversified investment, but some people who are unfamiliar with investment may not know how to distribute multiple stocks.。

The theme killer has 30 themes, and the lineup is wide, from trendy ones to long -term growth themes.It can be said that it is a unique service that reduces the hurdle to mini stocks further.

Many voices are rising not only for domestic stocks, but also for foreign stocks, investment trusts, and the abundance of products that can be traded from FX to gold and platinum.

In addition, it has been highly evaluated in terms of being able to trade with a price of 10,000 yen or less and ordering 24 hours a day, and it is highly evaluated not only for beginners but also for those who want to use the gap time during the break effectively.。

SBI証券の口座開設はこちら (画像=PayPay証券公式HPより引用)PayPay Securities is a typical securities company of "Smartphone Securities" that can be completed with smartphones, from opening accounts to stock search and order.

Many people have the image of collecting information and analyzing the charts when investing in stock investment, but PayPay Securities eliminates difficult operations and designs apps so that they can do as much time as possible.。For example, in stock trading, the application is completed with only 3 taps, (1) selecting a brand, specifying the desired amount, (3) buying, and tapping, so even beginners can feel more familiar with stock investment.Yes.

| ミニ株の名称 | - |

| 手数料 | 片道0.5%〜1.0%のスプレッドが発生 |

| 約定 | リアルタイム取引 |

| 取引時間 | 国内:9時00分10秒〜14時59分外国:24時間注文可能 |

| 取扱銘柄 | 国内:160銘柄米国:147銘柄 |

PayPay Securities is a securities company that was created by a strategic partnership between SoftBank and Mizuho Financial Group, and will develop and provide Japan's next -generation financial services.

PayPay Securities can also purchase stocks from a small amount, but unlike other securities companies' mini shares, they can purchase shares in 1,000 yen, not per share.

In other words, if it is a stock of 500 yen per share, 2 shares for 1,000 yen, for a company with 5,000 yen per share, 1,000 yen..You will have two shares.The great advantage is that you can purchase stocks of the company you want to buy according to your investment funds without worrying about the stock price of the brand.

In addition, there is an application called freshly saved robot savings, which allows US stocks to make a flat -rate reserve.This is a service that allows you to buy stock by specifying the amount.

At the time of transaction, the amount of the spread and subtraction of the purchase price and the selling price are the transaction price, and this spread is the commission of the securities company.In the case of domestic stock transactions, the spread is 0 from the time of the Tokyo Stock Exchange (9:00 to 11:00, 12:30 to 15:00).5 %, but in other times 1.It is 0 %, so be careful as it is more expensive than other securities companies.

It seems that PayPay Securities can be traded from the biggest attraction, "1,000 yen".In addition, it is easy to operate a smartphone, and not only Japanese stocks but also US stocks can trade small amounts, so it is especially popular among beginners that simply click on the stock you want to buy if you have 1,000 yen.On the other hand, you may feel unsatisfactory in that the stocks that can be traded are limited.

PayPay証券の口座開設はこちら (画像=auカブコム証券公式HPより引用)au Cabcom Securities is a company that provides internet financial services within the Mitsubishi UFJ Financial Group.

SBI Neo Mobile Securities and SBI Securities could invest in T points, but in the au Cabcom Securities' mini -shares "Petit shares", the common point service "Ponta" that can be stored with Lawson and hot pepper beauty.The feature is that you can purchase stocks.

For those who have many services that can use Ponta within the living area, it is a recommended securities company to start investing from a small amount.

| ミニ株の名称 | プチ株 |

| 手数料 | 約定代金の0.55%(最低手数料52円) |

| 約定 | 1日2回(前場始値、後場始値) |

| 取引時間 | 24時間注文可能 |

| 取扱銘柄 | 買付:東証、名証上場銘柄売却:東証、名証、福証、札証上場銘柄 |

au Cabcom Securities mini -shares are provided under the service name "Petit shares" and can be sold from one share like other securities companies.The common point service "Ponta" can be used for purchasing petit shares, and of course it can be used with cash, so it is suitable for starting stock investment with a small investment fund.

AU Cabcom Securities also provides "Premium Saving Co., Ltd.", which allows you to purchase petit shares in a funded method.The monthly reserve amount can be set for 500 yen or more 1 yen, and the monthly purchase fee is free.It is one of the most recommended securities companies for those who have purchased mini shares by funding.

Petit shares can receive dividends according to the number of shares, as well as mini -shares of other securities companies, and can buy stuff and petit shares to be used as a unit.For example, if you buy 58 shares for the first time with a petit strain, and buy 42 shares for the second time, you will get a total of 100 shares, so you can monitize it.

au Cabecom Securities is evaluated for buying and selling stocks from one share and buying stocks at Ponta points.In addition, smartphones can be easily bought and sold from purchases, and they have a good reputation because they do not charge.

On the other hand, it is a negative point that overseas stocks are not trading, but it is attractive for investors to be able to order by W -turn or time specification.

auカブコム証券の口座開設はこちら (画像=マネックス証券HPより引用)Monex Securities is also a very popular securities company in Internet Securities, but his major features are the largest of the US stocks and Chinese stocks.U.S. stocks can trade more than 4,700 stocks, and Chinese stocks can trade almost all stocks listed on the Hong Kong Stock Exchange.

By the way, US stocks do not have the concept of monetary or mini stocks, and all are transactions in one share.

| ミニ株の名称 | ワン株 |

| 手数料 | 買付:無料(0円)売却:約定代金の0.55%(最低手数料52円) |

| 約定 | 1日1回(後場始値) |

| 取引時間 | 0時〜11時30分、17時〜24時 |

| 取扱銘柄 | 買付:東証、名証上場銘柄売却:東証、名証、福証、札証上場銘柄 |

Monex Securities' mini shares are provided under the service name "One Share".There are also many stocks handled by the Tokyo Stock Exchange and name certificate, and it is attractive that most brands can trade for 10,000 yen.

Monex Securities is the first main online securities to make a free purchase fee for one stock, and it can be said that it is one of the securities companies that can still start shares at the lowest cost.As mentioned above, in mini -stocks, the burden ratio of the commission is inevitably high, so the 0 yen purchase fee is a great advantage.

If you think about small investment other than one share, we recommend Manex Securities' "Investment Trust Tsu".If you make an investment trust and purchase, you can save 100 yen a day from the purchase fee for purchase.

Although the transaction fee for the actual stock is from 110 yen, it is not the lowest level of online securities, but it can be said that it is an affordable commission to start full -fledged stock investment.

Monex Securities is highly evaluated for its abundant investment information and that the design of the screens such as investment charts is simple and easy to see.

In addition, it has been well received because it can be invested from a small amount of 10,000 yen per share and that it can be easily ordered.

On the other hand, it is a negative point that the order time is limited, such as being treated as the next business day after 11:30 am, but rather than repeating sales in a short period of time such as day trading, it is more slowly and long in the middle and long term.It can be said that it is a securities company that is suitable for those who invest.

マネックス証券の口座開設はこちら (画像=日興フロッギー公式HPより引用)Nikko Florgium is an investment service that allows you to buy stocks by browsing articles, and is operated by SMBC Nikko Securities.The feature is that the information media and the transaction function are integrated, and investors can read articles, learn information about investment, and immediately purchase the shares that they are interested in.

It can be said that it is a securities service that helps investors grow through practice.

| ミニ株の名称 | キンカブ |

| 手数料 | 買付:0〜1.0%のスプレッド売却:0.5〜1.0%のスプレッド |

| 約定 | 1日2回(前場始値、後場始値) |

| 取引時間 | 営業日:5時〜11時30分、16時〜翌日2時土日祝:5時〜翌日2時 |

| 取扱銘柄 | SMBC日興証券が指定する東証上場約3,700銘柄 |

Nikko Florgium is the biggest feature of being able to grow while studying investment.You can read more than 1,000 articles introduced by a variety of companies for free, and experience a new investment style of "buying the stock you care about while learning."

In addition, since the stock is not one share, it is possible to trade with the amount specified from 100 yen, so you can start investing in stock according to your budget without worrying about the stock price of the company you want to buy.

Spreads for stock investment are increased or reduced to the transaction price, but there is no spread for purchases of 1 million yen or less.In other words, stock transactions of 1 million yen or less are advantageous because there is no commission.Considering that you can buy shares from 100 yen, it is the cheapest securities company where you can start stock investment.

In addition, coordination is required in advance, but you can also invest using DOCOMO mobile phones, McDonald's, Lawson, etc. that can be stored.

Regarding Nikko Florgium, it is highly evaluated that you can enjoy the mood of shareholders from 100 yen, and that if you have a transaction of less than 1 million yen, the commission is free.You can learn your knowledge about investment through practice, and the company you want to read and buy an article should be a company that is somewhat interested, so you can learn investment practically.This is a service that is particularly attractive to beginners of the younger generation.

SMBC日興証券の口座開設はこちら (画像=岡三オンライン証券公式HPより引用)Okasan Online Securities is an online securities service of Oka San Securities, which is the core of the Okasan Securities Group, founded in 1923.Unlike other online securities that IT companies have entered a securities company, Okasan Online Securities has been using IT based on the know -how cultivated in the securities industry for many years using IT.Due to the pride, we provide high -quality investment information and investment tools.

| ミニ株の名称 | 単元未満株 |

| 手数料 | 1注文2万円まで220円、3万円まで330円、10万円まで660円以降10万円ごとに660円ずつ増加 |

| 約定 | 1日2回(前場寄値、後場寄値) |

| 取引時間 | 営業日:0時〜10時30分、16時15分〜24時 |

| 取扱銘柄 | 買付:東証、名証上場銘柄売却:東証、名証、福証、札証上場銘柄 |

Okasan Online Securities, taking advantage of the traditional investment know -how cultivated by the Okasan Group, focuses on providing useful information for transactions and investment.

For example, on the User -only investment information page called the "Investment Information Bureau", it emphasizes information fresh and ease of use, can be used intuitively like a general news site, and supports smartphones.In the market information, you can see not only "price rise", "price drop rate", "volume", but also "stock price soaring / plumbing", and "rankings by industry".

In addition, it is characterized by focusing on providing information, such as news videos and seminars by popular instructors.

There are plenty of trading tools, with a rich lineup, such as "Oka Sankantan Order", which is easy to use even for beginners, "Okasan Net Trader Premium", which can be ordered and analyzed, and "Net Trader Smartphone" for smartphones.It is.

Since it is a securities company with a long history, it is not so that the procedure is analog, and the account opening procedure is completed in a minimum of 5 minutes by filling out the necessary information from the web and uploading identification documents.。

Although Okasan Online has average as a securities company in terms of the number of products handled and commissions, it is also an online securities created by a securities company, so it is a voice that evaluates information and detailed construction of transactions.Is increasing.On the other hand, the function of the smartphone is a bit complicated, and this area is expected to improve in the future.

岡三オンライン証券の口座開設はこちらHow to start a mini stock

A mini -stock can be invested casually.I want to know how to get started.

Once you have a securities company that suits you, you will be able to invest in mini shares by performing an account opening procedure.You need to send an application form for the procedure, but now you can upload a copy of the documents on the web, and the procedure has been considerably simplified, so you can easily start.

Here are some steps to start mini shares.

To start a mini -shares, you must first open an account at a securities company.As we have introduced so far, stocks are originally traded in monetary strains, so it is determined whether the securities company provides a mini -shares service whether it can be traded under the unit.Make sure to check in advance whether mini -shares are handled on websites and inquiries.

Which stocks can be bought with mini shares are different for each securities company.For the time being, if you want to experience investment from a small amount, it is important to use fees and ease of use of trading tools, but if you really want to buy stocks from a specific company, we will handle the stock with a mini stock.Let's check if there is.

Once a securities company is decided, we will actually open a trading account.To open a trading account, you need to submit a copy of your identity verification documents and a copy of My Number card, but some internet securities can complete the procedure simply by uploading them on the web.If you want to start trading mini -shares immediately, you may want to compare the ease of opening an account.

Q.What documents do you need when opening an account?A.When opening a trading account (general account or specific account) at a securities company ・ "My Number (personal number) confirmation documents" ・ "Democratic verification documents (driver's license, various health insurance cards, various pensions, various pensions, passports, etc.)"・ "Seal" ・ "Financial institution account" is required.The flow of the account opening is (1) request for an account opening application form via the store or the Internet or telephone (2) Submit the necessary documents with the required documents (Internet or the Internet (Internet or other).If you request by phone, return the documents.) (3) After the screening, the opening will be completed.

Mini shares can be started with a small amount, and it is easy to invest in diversified investment, but it is not the original transaction unit, so it has a characteristic that is different from normal units stock trading.

The biggest feature of mini -shares is that the amount of shares cannot be specified.In other words, the main order is.The market order is an order method in which the trading price is the stock price at that time because the order is issued without specifying the amount.

In general, mini -stocks are determined to be twice to three times a day, so the price at the time of the order may have changed.The disadvantage that you can't buy at the price you want to buy is a difficult way to predict price movements, and it is an easy order for those who aim for contracts anyway.

Points to select stocks for mini shares and shares less than unit

Even if you say a mini stock, I don't know which stock to buy.

Of course, it is important to check the information of the brands you care about, but when you invest, make sure you decide the purpose of your investment.There are multiple profits that can be expected in mini -shares, so choose a stock that can make a profit you want.

Mini -shares and shares under the unit are casual investments that can be started even with a small amount, but because they are easy, you will not be able to make a profit even if you make any strategies.Here are some points when choosing a mini -stock stock.

First of all, as a major premise, collect information from the company that is considering purchasing.For those who want to make a profit by the rise of stocks, it is essential to collect corporate information even for those who start stocks with the expectation of dividends, etc.No matter how much dividends you receive, it is meaningless if the stock price is greatly reduced and the loss due to the sale is larger than the dividend.

If you want to buy and sell stocks in the short term, buy a stuff and mini -shares and make money carefully, choose a high -paying stock.One of the benefits of mini shares is that you can receive dividends even under the unit shares.

There are two types of interest in stock investment, including mini -shares,: capital gain and income gain.

Capital gain is a trading gain gained by selling assets you have, such as stocks and bonds.For example, if the stock purchased at a stock price of 300,000 yen is sold at 350,000 yen, the difference of 50,000 yen (excluding commissions and taxes) will be capital gain.Capital gains can be obtained not only by stocks and bonds, but also by buying and selling precious metals such as real estate, gold, and platinum.

Income gain is a revenue that can be obtained while holding assets such as stocks and bonds.For example, dividends in stocks, interest in bonds, and real estate rents can be rented by renting in income gain, and you can expect continuous income by continuing to hold these assets.

Normally, when you hear that you made a profit with stocks, you can imagine the capital gain that you get from buying and selling it at a high price, but it is one of the great strategies to start investing in stocks for the purpose of dividends for income gain.

Which profit you want is an important factor in choosing a brand, so be sure to decide your investment policy in advance.

If you are attracted to shareholder benefits in stock investment, choose stocks that can receive shareholder benefits from one share.The content of shareholder benefits varies from company to company, so it is better to check the contents and special treatment conditions.

If you can receive special treatments for your favorite brands and frequently used daily necessities, you will be able to feel the benefits of stock investment.

Recommended mini stock

What kind of stock should I choose if I buy a mini stock for the first time?

In mini -stock investment, the recommended stocks differ depending on whether they expect to increase the price of stock prices, to expect a dividend, or expect shareholder benefits.Here are a few recommended brands for each expected profit.Please refer to the brand selection.

Here are seven specific stocks that can be expected to have capital gain, income gain, and shareholder benefits.

(画像=日本取引所グループ HPより引用、2022年1月12日午後終値時点)The SoftBank Group is a holding company that includes SoftBank Mobile, a major telecommunications company, ZOZO, ASKUL, and PayPay Banks.

| 株価 | 5,683円 |

| 配当利回り(%) | 0.77% |

| 時価総額 | 9兆7,915億4,604万7,590円 |

| 株主優待制度 | なし |

The SoftBank Group does not have high dividend yields (indicators indicating what percentage of the annual dividend per share) is not high and has not implemented a shareholder preferential system, so it is for income gain.Not suitable.

However, since the investment business is also conducted in the group, the price of stock prices can be expected to rise in the future.It is recommended to invest in a mini stock and aim for capital gain.

(画像=日本取引所グループ HPより引用、2022年1月12日午後終値時点)Honeys Holdings is based on "high -sensitivity, high quality, and reasonable price" as a key concept and provides ladies fashion for a wide range of people in their teens and 60s.

| 株価 | 1,015円 |

| 配当利回り(%) | 2.96% |

| 時価総額 | 283億1,850万円 |

| 株主優待制度 | あり |

The stock price of Honeys Holdings is about 1,000 yen, which can be easily invested compared to famous major companies.It is also suitable as a stock that keeps buying it and aims for monetary stocking.

If you have more than 100 shares, you will get a 3,000 yen shareholder coupon and you can use it at Honeys stores nationwide.

(画像=日本取引所グループ HPより引用、2022年1月12日午後終値時点)The Japanese tobacco industry is a holding company that manufactures and sells tobacco, food, beverages, and pharmaceuticals.

| 株価 | 2,367.5円 |

| 配当利回り(%) | 6.5% |

| 時価総額 | 4兆7,350億円 |

| 株主優待制度 | あり |

The characteristic of the Japanese tobacco industry is that the dividend yield is 6.It is as high as 5 %.In 2020, the dividend per share was 154 yen, so it is recommended for those who want to increase profits in the middle and long term.

For shareholder benefits, you can get products from the Japanese tobacco industry worth 2,500 yen for more than 100 shares.

(画像=日本取引所グループ HPより引用、2022年1月12日午後終値時点)Japan Post is a Japanese Post Group's holding company that is closely related to living, such as Japan Post, Japan Post Bank, and Kanpo Life Insurance.

| 株価 | 991.9円 |

| 配当利回り(%) | 5.04% |

| 時価総額 | 3兆7,373億5,048万145円 |

| 株主優待制度 | あり(2022年3月より) |

The feature of Japan Post is that the dividend yield is high and the stock price can be purchased at a reasonable price of about 1,000 yen.This brand is also suitable for capital gain investment.

Currently, there is no shareholder preferential system, but as of March 31, 2022, shareholder benefits will be started for those who have more than 500 shares.

(画像=日本取引所グループ HPより引用、2022年1月12日午後終値時点)Joshin Denki is a large specialty store for home appliances, PCs, and hobbies, headquartered in Osaka.In addition, Kids Land, a family -oriented comprehensive entertainment shop, is also available.

| 株価 | 2,108円 |

| 配当利回り(%) | 3.56% |

| 時価総額 | 590億2,400万円 |

| 株主優待制度 | あり |

The feature of Joshin Electric is that all shareholders can receive shareholder benefits.You can receive 25 (5,000 yen) 200 yen tickets (5,000 yen), even if you only have a single share in mini -stock investment.

If you have more than 100 shares, you will add a shareholder specialty ticket, and if you hold it for more than 2 years, it will be added more.It is especially recommended for those who want to invest in mini -shares for the purpose of shareholder benefits.

(画像=日本取引所グループ HPより引用、2022年1月12日午後終値時点)Askuru is a mail -order company of the SoftBank Group affiliate introduced above.Office supplies are particularly famous, but we sell abundant products, including tools, medical and nursing care necessary for manufacturing sites.

| 株価 | 1,527円 |

| 配当利回り(%) | 3.21% |

| 時価総額 | 1,565億4,620万7,600円 |

| 株主優待制度 | あり |

You can receive a LOHACO coupon for ASKUL's shareholder benefits.LOHACO is a mail order site that sells products that are closely related to life, such as food, daily necessities, and cosmetics, which will save you living expenses.

However, the shareholder benefit that had been purchased at least one share has been changed to more than 100 shares since November 20, 2021.

(画像=日本取引所グループ HPより引用、2022年1月12日午後終値時点)Nintendo is a major Japanese company that mainly develops, manufactures and sells computer games and toys.There are many hit products such as Nintendo 3DS and Nintendo Switch.

| 株価 | 53,590円 |

| 配当利回り(%) | 4.14% |

| 時価総額 | 6兆9,596億7,971万円 |

| 株主優待制度 | なし |

With the trend of new colon viruses in recent years, the time spent at home has increased, and demand for TV games that can be easily played indoors is growing.Although the social situation in the future is unclear, it is unlikely that the new Corona will end immediately, and it is expected that game demand will continue for a while.

If you try to buy Nintendo's stock price with a unit stock, you need more than 5 million yen, but mini stocks can become shareholders for 50,000 yen.One of the attractions of mini shares is that you can buy stocks of such large companies for tens of thousands of yen.

You can apply and purchase for IPO with a mini stock

Is there any other recommended investment method using mini shares?

Although the number is limited, there are securities companies that can be applied for lottery to purchase the company's stocks before listing with mini shares.It is said that if you win, you will make a profit with a high probability.

Some securities companies can purchase IPO stocks that usually need to apply for 100 shares from one share.For example, in SBI Neo Mobile Securities's "IPO" and PayPay Securities "Everyone IPO!", You can apply from one share and anyone can easily participate in IPO investment.

In order to purchase IPO shares, it is necessary to win the lottery that the securities company is doing, but the lottery method is for each securities company, and some investors with large number of applications are easy to win.I have.However, it is expected that many people will be able to participate in IPO investment from a small amount, which will have a chance to win.

IPO is the company listing and publishing new shares.

From a state where a stock company is owned by a small number of shareholders such as owners and is restricted (unpublished company), it is owned by an unspecified number of shareholders by listing on the financial instrumental exchange market.It is called stock disclosure to be a state where you can freely buy and sell (public company).

In the IPO investment, the initial price (the first stock price on the listing day) is often higher than that of the public offering price (the price set at the time of the lottery), and it is said that if you sell it immediately after the listing, you can expect a profit with a high probability.。

Points of small investment

I'm used to mini stocks.Next, what are the recommended steps?

Mini shares are one of the small investments that can be started with a small amount of money.There are several other types of small investments, so if you try them, you will have a wider range of investments.It is also recommended to deepen your understanding of the preferential treatment system, such as NISA, which is compatible with small investment and has become a hot topic in news in recent years.

An investment that can be made small, including mini shares, is called "small investment".Here, we will introduce the recommended investment method for small investment and the "NISA" system that you should definitely know if you make a small investment.

I think it is different for each person how much the amount can be said to be "small amount", but in general, investment of 100,000 yen or less is often "small investment".At present, the number of small investment variations is increasing, and the hurdles for investment are declining, such as investing for 100 yen and buying stocks for various points.

Until now, investment was to save a lot of investment funds, analyze corporate information and charts, and fix it with a personal computer.However, if you can easily invest even at a small amount, it will be easier for young people to enter into investment, and recently a securities company that can complete transactions with smartphone apps alone will be born more familiar.I am.

Stock investment is an investment method of purchasing individual shares at once with a large amount of money, but the investment method that accumulates fixed amounts every month and buys stocks is said to be a cumulative investment.

Normally, you can start from 10,000 yen a month, but SBI Neo Mobile Securities, au Cabcom Securities, and PayPay Securities can invest in a small amount of mini -stocks.

The investment method that accumulates a certain amount every month is said to be a dollar cost average method, and it is said that large losses are less likely to occur compared to normal investment.

-The dollar cost average method -A method of purchasing a certain amount regularly to reduce the unit price of stocks and investment trusts that fall and decline.Distributing the purchase time has the effect of reducing price fluctuation risk.If you invest a certain amount regularly, you will often buy a small number of shares when the stock price is low, and when the stock price is high, the purchase price per share is averaged.

If you are thinking about investing in mini stocks, consider the use of NISA.

-NISA -If you invest in financial products such as stocks and investment trusts, you will get about 20 % tax on the profit you get from the sale of them and the received dividends.NISA is a system in which the profits obtained from these financial products purchased within a certain amount every year within a certain amount of money in the "NISA account (tax -exempt account)" are tax -exempt, that is, tax is not applied.

NISA is a great deal for tax exemption, but the upper limit of the amount that can be invested is 1.2 million yen per year.

As mentioned above, in normal stock investment, the investment funds cost tens of thousands to millions of yen, so the number of stocks that can be purchased for 1.2 million yen will be limited and distributed investment will be difficult.

However, if you have 10,000 yen, a mini stock that can buy stocks will increase the number of options you can buy, and you can use the NISA frame without waste.

In this way, mini shares and NISA are very compatible combinations.However, it depends on the securities company whether the mini -stock service is compatible with NISA.

ミニ株に関するQ&A

If you start investing in stocks casually, put a mini stock (shares under units) as an option

We introduced the characteristics and recommended securities companies for mini shares (shares under units).If you use a mini stock, you do not need money to invest in stock, and you can trade with a gap time only with a smartphone.It can be said that the hurdle for stock investment is much lower than a long ago ago.If you've been interested in investing for a long time, start by opening an account at a securities company you are interested in.

| 関連記事 |

|---|

| ・【初心者必見】おすすめ証券会社10選!基本情報からおすすめポイントまで徹底解説・つみたてNISA口座開設におすすめの証券口座10選!口座の選び方も解説・【どんな人におすすめ?】人気のネット証券・楽天証券とSBI証券の特徴を徹底比較!・NISAの最大のデメリットとは?失敗しないために知っておきたいポイントを徹底解説!・【種類別】ETFのおすすめ銘柄は?特徴やメリット・購入できる証券会社を紹介 |